USDC and USDT are currently the world’s leading stablecoins, with a combined share of more than 80% of the stablecoin market. Both are backed by a proportionally 1:1 amount of traditional assets like cash, making the price of a stablecoin stay pegged to $1.

Since traditional finance hasn’t found a solution to real-time and compliant cross-border payments yet, more money service businesses (MSBs) are turning to using stablecoins in such transactions every passing day. However, most of them are conducted off-the-books, relying on the trust each party has for the other. This raises legitimate security concerns for not only MSBs on both ends but also for the health of the global finance industry.

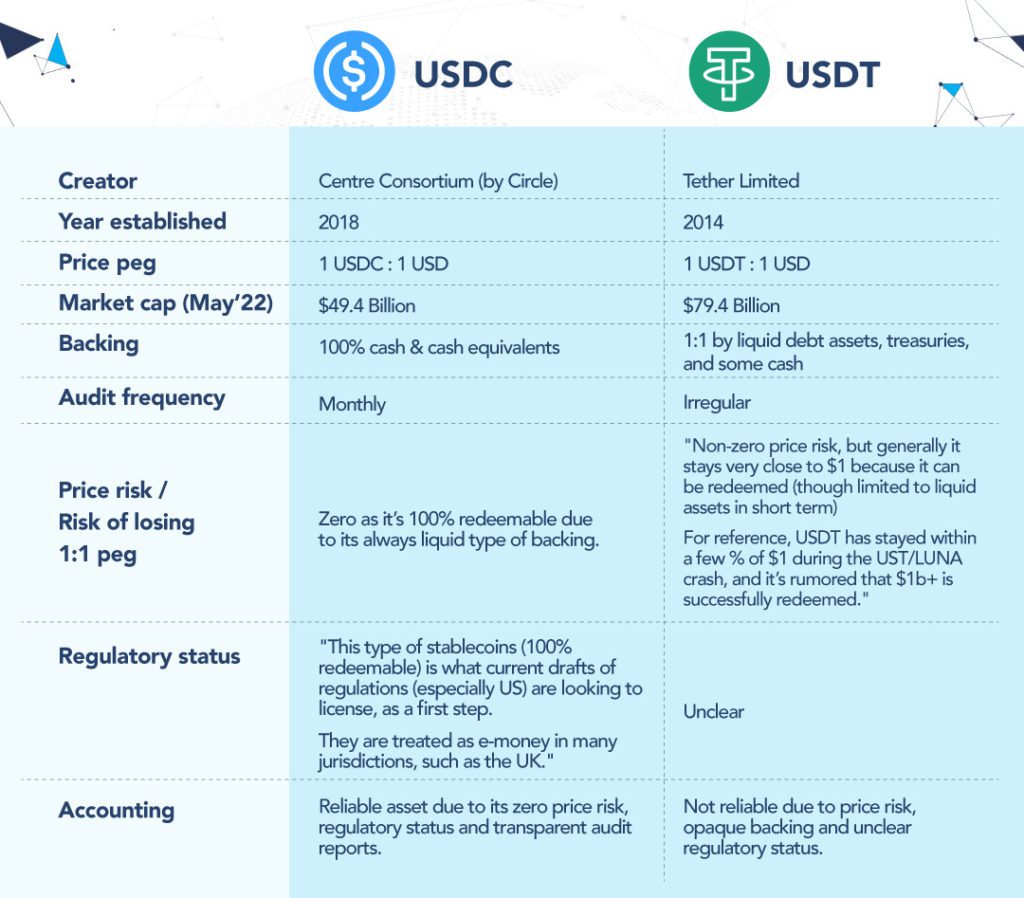

We’ve put together the features of USDC and USDT, the most popular stablecoins in the world, to provide a complete picture for MSBs looking for a digital asset to utilize.

USDC and USDT currently dominate the stablecoin market, with a combined share of more than 80%.

World’s first stablecoin, Tether (USDT), is the biggest stablecoin with a $79.4 billion market capitalization as of May ’22. USD Coin (USDC) makes the second biggest one, with a market capitalization worth $49.4 billion as of May ‘22.

The report published by Centre in October 2021 shows that 100% of USDC reserves are made up of cash and cash equivalents. The higher proportion of cash and cash equivalents indicates its ability to fund large-scale USDC redemptions in case of a crisis.

On the other hand, Tether was fined $41 million for claiming its digital tokens were fully backed by fiat currencies in 2021, creating a worldwide distrust to the honesty and transparency of the issuer. After endless allegations, Tether published a report in December 2021, revealing that 84% of its assets are in cash, cash equivalents, short-term deposits, and commercial papers.

As of April 2022, the global stablecoin market reached over $181 billion in size. Given their potentially disruptive impact, regular audits of stablecoins by independent auditors have vital importance.

USDT is currently audited irregularly, which raises questions about its transparency. On the other hand, USDC is audited once a month by a Top 5, TIER1 accounting firm to attest that it is 100% backed.

We’ve put together a table with the key differences between USDC and USDT:

| USDC | USDT | |

| Creator | Centre Consortium (by Circle) | Tether Limited |

| Year Established | 2018 | 2014 |

| Price Peg | 1 USDC : 1 USD | 1 USDT : 1 USD |

| Market cap (May’22) | $49.4 Billion | $79.4 Billion |

| Backing | 100% cash & cash equivalents | 1:1 by liquid debt assets, treasuries, and some cash |

| Audit Frequency | Monthly | Irregular |

| Price Risk / Risk of Losing 1:1 Peg | Zero as it’s 100% redeemable due to its always liquid type of backing. | Non-zero price risk, but generally it stays very close to $1 because it can be redeemed (though limited to liquid assets in short term)

For reference, USDT has stayed within a few % of $1 during the UST/LUNA crash, and it’s rumored that $1b+ is successfully redeemed. |

| Regulatory Status | This type of stablecoins (100% redeemable) is what current drafts of regulations (especially US) are looking to license, as a first step.

They are treated as e-money in many jurisdictions, such as the UK. |

Unclear |

| Accounting | Reliable asset due to its zero price risk, regulatory status and transparent audit reports. | Not reliable due to price risk, opaque backing and unclear regulatory status. |

Both USDC and USDT are pegged to the USD, and both are very popular. Although USDT is the biggest stablecoin yet, USDC is rapidly catching up, with a growth rate of 5x in the past 12 months. USDC is fully backed by cash and short-dated U.S. government obligations. Considering that USDC is a much safer store of value, this rapid increase is no coincidence.

In terms of many aspects, including how it was backed and audited and regulatory status, USDC proves to be a more reliable asset for Money Service Businesses.

Arf only works with attested, audited, and fiat-backed stablecoins of 1:1 peg like USDC. By leveraging reliable stablecoins, Arf enables MSBs to achieve fully compliant and real-time fiat-to-fiat cross-border payments.

Want to learn more? Get in touch with us.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.