UK current account switching hit 1.2 million in 2024, but banks face retention issues as digital challengers win loyalty with seamless, transparent customer experiences.

The UK banking sector experienced a surge in current account switching in 2024, with 1.2 million customers switching providers. Despite high-value cash incentives of up to £200, nearly two-thirds of these customers departed within six months. This retention pattern emerged even as banks invested heavily in digital capabilities and attempted to differentiate their offerings. While there are various points for analysis, the following three are of particular interest:

Importantly, there is a significant shift in consumer behaviour that demands strategic reconsideration of customer-focused current account switch service (CASS) offerings and their ongoing relevance in today’s banking environment.

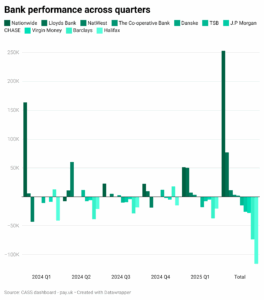

The UK banking landscape has dramatically shifted, with digital challengers redefining customer expectations. Neobanks like Monzo and Starling have consistently emerged as net winners in the switching battle, without offering cash incentives, by succeeding through superior user experience and functionality.

Rather than immediately switching accounts for potential experience benefits, customers typically try neobank apps alongside their traditional accounts, gradually increasing usage until they question why they maintain their legacy accounts. This try-before-you-buy approach offers a more organic path to customer acquisition than traditional switching incentives.

Legacy banks face significant challenges in keeping pace with the digital-first approach. Even customer service leaders like First Direct struggle to pivot effectively to a digital strategy. As ambassador of The Payments Association, Mark O’Keefe, notes, “I think it’s hard to digitise a human. First Direct have those lovely people in Leeds, but you can’t put them into the app.”

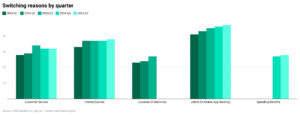

While CASS facilitated 1.2 million switches in 2024, the system primarily serves a specific customer type. These “savvy switchers” move accounts for cash incentives before moving on when those incentives expire, similar to “rate tarts” in the balance transfer market of years past.

The transient nature of these customers poses a fundamental question for traditional banks: Can they convert bonus chasers into loyal customers? The answer appears to be no. As O’Keefe explains, “How can banks convert savvy switchers into loyal customers? I don’t think they can. Because they’re savvy and therefore they’ve read the offer for what it is, which is a temporary bait.”

“How can banks convert savvy switchers into loyal customers? I don’t think they can. Because they’re savvy and therefore they’ve read the offer for what it is, which is a temporary bait.”

– Mark O’Keefe, ambassador, TPA

Chase Bank provides a telling example, initially winning customers with cashback rates. Once these promotional rates ended, customers began leaving, demonstrating that even alternative incentive structures face the same loyalty challenge as traditional cash bonuses.

Traditional institutions face multiple barriers to competing effectively in this changing landscape. Banks often misuse app real estate for aggressive selling rather than focusing on customer needs, which contrasts with the arguably more contextual and customer-centric approach of neobanks.

Legacy banks are attempting to attach more conditions to switching incentives, which could make them less attractive. As O’Keefe explains, “It’s no longer here’s 200 quid, no strings attached, it’s here are all the hoops you have to get through to get this money,” making offers increasingly convoluted.

Perhaps most significantly, the CASS system itself has limitations in today’s open banking environment. While it transfers direct debits and standing orders, it cannot transfer open banking consents, creating friction for digitally engaged customers. This potentially undermines CASS’s original vision as a seamless “porting service” for the banking industry.

When 78% of UK customers distrust bank fees, according to the Financial Conduct Authority’s 2024 survey, the industry faces a transparency challenge that goes to the heart of how banks communicate with their customers.

The trust crisis reflects deeper issues about how different banks approach their customers. O’Keefe tells Payments Review that transparency problems are fundamentally “a manifestation of how people view the brand,” noting that customer service leaders like First Direct and Nationwide are being overtaken in satisfaction surveys by digital-first challengers Starling and Monzo.

This complexity problem extends beyond static terms and conditions into everyday customer interactions, where traditional banks often compound user frustration. O’Keefe explains that “Traditional banks have undermined trust through aggressive in-app marketing that interrupts rather than assists,” describing how their mobile apps constantly prompt users with intrusive pop-ups trying to sell additional products. This creates a stark contrast with neobanks, which instead centre their experience around what the customer is actually trying to accomplish.

This behavioural difference becomes particularly stark when examining switching incentives. Where Lloyds might score 8/10 for complexity in their terms, the industry’s broader trend is ostensibly making things more challenging. Banks are attempting to attach conditions to offers that make them appear convoluted and less attractive, abandoning the straightforward approach that once proved effective.

The regulatory response through the FCA’s Consumer Duty rules is forcing change, but the damage appears deeply rooted. Banks that once offered clean £200 switching bonuses now present customers with elaborate qualification criteria. The shift from “no strings attached” to multiple hoops has made these offers increasingly unappealing.

Meanwhile, open banking has empowered comparison tools like Snoop and Emma, pressuring banks to clarify their fee structures as customers can easily aggregate and compare costs across providers. This technological transparency is succeeding where regulatory pressure has struggled, with Starling’s straightforward fee-free overseas spending attracting switchers from more complex rival offerings in 2024.

As the competitive landscape evolves, customer outcomes have become the central battleground. Rising interest rates have made consumers more aware of better deals elsewhere, driving them to actively shop around. According to Phoebe Wallis, chief revenue officer at Griffin, this shift is fueling the success of digital-led products, which deliver seamless, transparent, and personalised experiences—features now prioritised by nearly half of switchers. Wallis observes that in recent months, it is the banks focused on genuinely good customer outcomes, rather than those relying on complex terms, that are winning both the compliance and retention battles. In this environment, transparency is no longer merely a compliance requirement—it is a core competitive differentiator.

The winners in this transparency battle aren’t necessarily those with the simplest terms, but those whose entire customer experience reflects clarity of purpose rather than opportunistic complexity.

The multi-banking revolution has fundamentally altered how financial institutions must approach customer loyalty. With the average Briton now holding more than two current accounts, banks can no longer rely on being the sole destination for a customer’s salary.

“At a basic level, the way that banks can incentivise customers to switch will always be tied to the value that they expect to generate through the relationship, and for most banks, the current account used to be more or less the whole ballgame. That’s all changing now,” explains Aiste Krevneviciute, vice president of member accession at Tide. “As our ability to understand our members through the lens of their transaction data increases, it means that we can get a really granular picture of what we can do to support their business and what products they need to keep things moving in the right direction. So as we add more value for the members, we create more value for the bank.”

This data-driven approach is already showing results. Krevneviciute adds: “For example, more than half of the members who switch to Tide through the Current Account Switching Service (CASS) are already using 2 or more Tide products. That wasn’t true a year ago, and the more problems we solve for these members, the more we create value on both sides of the equation. In turn, that means it makes sense to accept higher acquisition costs in order to get that ball rolling.”

This evolution extends beyond product cross-selling. Revolut’s entry into the mobile market demonstrates an ecosystem approach, with their ESIM for data roaming becoming their most popular non-financial offering. Now expanding into full mobile service provision, they’re creating a ‘super app’ where banking is just one component of a broader relationship.

N26 has announced similar plans, while other digital banks are expanding into insurance and travel services. This approach transforms the relationship from transactional to lifestyle-integrated, making switching less appealing.

Despite these innovations, significant obstacles remain for traditional banks attempting to follow suit. The open banking ecosystem creates particular challenges for the CASS. While CASS moves direct debits and standing orders, it cannot transfer open banking consents, creating friction for digitally engaged customers.

As Richard Ransom, head of corporate solution consulting for UK, EU, ROW at Bottomline, explains: “Uncertainty on how emerging payment types like cVRP (commercial variable recurring payments) will work with the account switch service may lead to operational issues, and changes to processes may be necessary. Organisations should look for full automation of their CASS processes to help with insulation from some of the change that will be necessary. Longer term, the outputs of the National Payments Vision (NPV) may also impact how CASS operates.” This limitation undermines CASS’s original vision as a seamless “number porting service” for banking—a vision that’s increasingly important as financial relationships become more complex and digitally integrated.

“Organisations should look for full automation of their CASS processes to help with insulation from some of the change that will be necessary.”

– Richard Ransom, head of corporate solution consulting UK, EU, ROW, Bottomline

Looking ahead, another frontier is emerging in the junior/youth market. With offerings like Revolut Jr, Starling Kite, and Monzo’s under-16 accounts, banks are establishing relationships with customers before they reach adulthood.

The convenience of digital junior accounts compared to traditional branch-based offerings is creating loyalty from an early age, potentially eliminating the need for switching entirely. As these ecosystems mature, the value created will likely extend far beyond the traditional current account, reinforcing the insight from Tide that understanding customers “through the lens of their transaction data” is the key to lasting relationships in banking’s new era.

The current account switching landscape demands strategic recalibration from payments executives. Traditional acquisition tactics are failing: cash incentives attract transient customers whilst genuine loyalty stems from seamless digital experiences and transparent value propositions.

Three critical actions emerge for 2025. First, prioritise retention over acquisition by investing in data analytics that predict and prevent customer departure rather than simply replacing departing accounts. Second, modernise payments infrastructure to support ecosystem integration, as customers increasingly expect unified financial services rather than standalone banking relationships. Third, address the CASS limitation around open banking consents, which creates friction for digitally engaged switchers.

Robust payment infrastructure is increasingly critical as financial services shift toward embedded, ecosystem-based models. This is especially true for digital wealth and investment platforms, where seamless and secure movement of funds underpins trust. Dennis Cheng, principal at Gladius Assurance Services Limited, notes that “a seamless payment infrastructure, underpinned by robust CASS client money protection throughout the payment lifecycle, is vital” for enabling near real-time transactions. In today’s market, such resilient payment rails are no longer optional—they are foundational to delivering a compliant, scalable, and frictionless client experience.

The organisations succeeding in this environment are those building comprehensive digital ecosystems where payments become embedded within broader lifestyle services. For payments leaders, the question is how to leverage established strengths whilst eliminating the friction points that drive modern switching behaviour.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.