2025 Government Greenhouse Gas Conversion Factors for Company Reporting

Major changes to the Conversion Factors

Major changes to the Conversion Factors

In a new blog post for the ESG Working Group’s ESG Toolkit, we dive into how TPA Member G+D Netcetera have championed sustainability ratings. We discuss their experience of partnering with GoCodeGreen

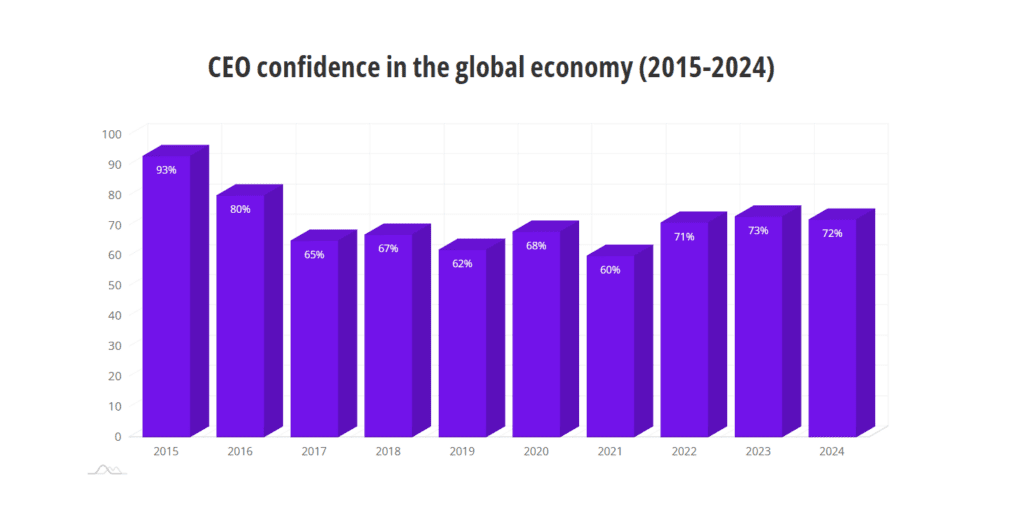

Top CEOs see through global turbulence by betting big on AI – Navigating a decade of disruption: Ten years of the KPMG CEO Outlook research shows CEO confidence in their organization’s future, despite geopolitical and economic volatility.

Crif joined December’s ESG Working Group meeting to present the importance of sourcing accurate carbon calculation data for financial institutions. Their findings revealed that a significant percentage of consumers are willing to switch providers if their current financial institution does not demonstrate strong ESG commitments and that transparency in operations and a proactive approach to environmental and social governance are crucial for building consumer trust and loyalty.

In this episode of the Insights Podcast, Tom Mason, co-founder of Shoal, and Marten Moller, Impact and Partnerships Manager at Algbra, discuss how fintech and banks can collaborate to create the next generation of sustainable financial products.

The SEDG is a guide to help your company decide what Environmental, Social and Governance (ESG) disclosures to track and report. It covers indicators that can be tracked and disclosed to measure ESG progress. The target users are SMEs that are compelled to track and report on ESG data – usually because they want to, they are being asked to, or they want to qualify for

incentives.

Project Nemo has launched a brand new podcast series – Accessible Finance – Demystifying Disability Inclusion. The limited-edition series will dive into different elements of disability inclusion, from inclusive workspaces and inclusive products and services to legal and regulatory requirements and how we measure progress.

Becoming a B Corp as an early stage fintech has the potential to massively drive growth for your business. As a newly certified B Corp, Griffin are excited to share our journey and encourage other fintechs to consider this path.

In our latest episode, editor Jyoti Rambhai spoke to Charlie Bronks, head of sustainability at Crown Agents Bank and Marten Möller, ESG Manager at Algbra – both recently b-corp certified – about their journeys to become b-corps and why this is important in the payments space

The Tech Talent Charter’s Open Playbook is an open-source catalogue of actionable strategies, resources, and case studies to support organisations of any size to drive diversity and inclusion (D&I) in

This report defines common metrics for sustainable value creation. Stakeholder Capitalism Metrics can be used by companies to align their mainstream reporting on performance against ESG indicators and track their

More than 1,300 global CEOs share their views on geopolitics, return-to-office, ESG and generative AI.

Forward-Looking Financial Sector Metrics Consultation

A checklist aimed at helping companies implement socially and environmentally responsible policies, authored by outdoor apparel organisation Patagonia, known for its high standard of ESG and CSR. The checklist covers

A framework that maps how systems transform and lays out a new framework to guide business action in the decade ahead.

This paper aims to help companies by providing guidance on the materiality assessment process in the light of recent developments in reporting requirements and advice on overcoming common challenges.

The establishment of a Loss and Damage Fund was, for many, the highlight of the United Nations Climate Conference (COP 27) and the culmination of decades of pressure from climate-vulnerable

The United Nations Global Compact–Accenture CEO Study offers a candid look at perspectives of more than 2,600 CEOs across 128 countries and 18 industries at the urgent opportunities and challenges

Huw Jones at Reuters describes the global framework set out in November 2021 to better police environment, social and governance (ESG) investment ratings and help combat ‘greenwashing’ in the fast-growing,

EcoAct expert Jordan Hairabedian provides an overview of the EU taxonomy, a classification of economic activities representing more than 93% of greenhouse gas (GHG) emissions in the EU, and how

ESGpedia is a one-stop registry of ESG data and solutions for financial institutions, corporates, and SMEs, to enable multiple sectors across Asia towards Net Zero and decarbonisation financing.

The mission of the Impact-Weighted Accounts Project is to drive the creation of financial accounts that reflect a company’s financial, social, and environmental performance. Their ambition is to create accounting

A leading partner for organisations ready to address humanity’s grand challenges to create a better future. They aim to enable decision makers to manage complexity, define their future position and

News article outlining European Union on proposals for new regulations for firms selling environmental, social and governance (ESG) ratings that could force some to restructure their businesses in a major

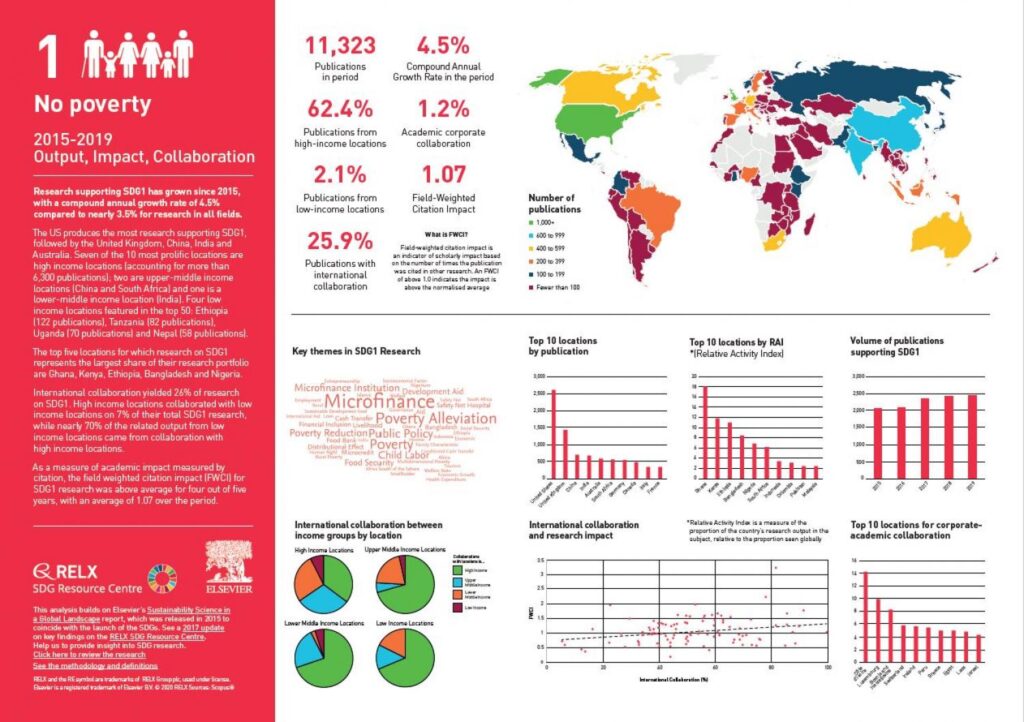

The Sustainable Development Goals (SDGs) set out the UN agenda for people, planet and prosperity through 2030. The SDGs were adopted by 193 states at the United Nations in September 2015.

Examples of how financial services are implementing sustainable development goals. These matrix’s show industry-specific examples and ideas for corporate action related to the SDGs. Presented in a series of publications,

Resources on the implementation of the seventeen UN Global Goals. Whether you’re a business or employee, at the start of your sustainability journey or developing your next set of commitments,

Rebecca Speare-Cole at the Independent highlights how the UK may introduce measures against ‘Greenwashing’ in response to the International Sustainability Standards Board (ISSB) publication of its inaugural standards to help

Transforming the EU’s economy for a sustainable future – an overview of what the EU has already achieved and futher initiatives.

ESG | The Report is a group of like-minded professionals that focus on ESG principles and socially responsible investment for a more sustainable future. ESG The Report provides information and

B Lab is the non-profit network transforming the global economy to benefit all people, communities, and the planet. Their international network of organizations leads economic systems change to support our

ESG and Corporate Success – Bain’s Axel Seemann and Jacqueline Han discuss research on ESG business value with EcoVadis’s Sylvain Guyoton.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.