Getting ahead with sustainability

In a new blog post for the ESG Working Group’s ESG Toolkit, we dive into how TPA Member G+D Netcetera have championed sustainability ratings. We discuss their experience of partnering with GoCodeGreen

In a new blog post for the ESG Working Group’s ESG Toolkit, we dive into how TPA Member G+D Netcetera have championed sustainability ratings. We discuss their experience of partnering with GoCodeGreen

The FCA have prepared this report following an invitation by the Department for Environment, Food and Rural Affairs (DEFRA) to report on climate change adaptation challenges faced by the financial services firms they regulate. This is part of the 4th round of reporting under the climate adaptation power.

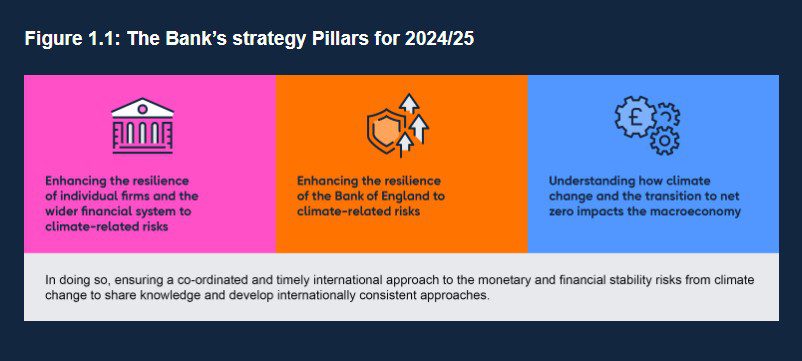

The PRA has produced this report in response to an invitation by the Department for Environment, Food & Rural Affairs (DEFRA) to participate under the fourth round of the climate change adaptation reporting power.

Crif joined December’s ESG Working Group meeting to present the importance of sourcing accurate carbon calculation data for financial institutions. Their findings revealed that a significant percentage of consumers are willing to switch providers if their current financial institution does not demonstrate strong ESG commitments and that transparency in operations and a proactive approach to environmental and social governance are crucial for building consumer trust and loyalty.

In this episode of the Insights Podcast, Tom Mason, co-founder of Shoal, and Marten Moller, Impact and Partnerships Manager at Algbra, discuss how fintech and banks can collaborate to create the next generation of sustainable financial products.

Becoming a B Corp as an early stage fintech has the potential to massively drive growth for your business. As a newly certified B Corp, Griffin are excited to share our journey and encourage other fintechs to consider this path.

In our newest episode of the Insights Podcast, Charlie Bronks, Crown Agents Bank, and Karine Martinez, Edenred, talk successful ESG policies, greenwashing and what effective green action really means.

They discuss how their companies have successfully tackled implementing ESG strategies and what other payments industry players should be doing to limit their impact on the environment and galvanize their customers.

KAE’s Payments and Sustainability Expert, Chris Holmes, speaks about 3 key roles payment companies can play in sustainability and the ESG space.

Hear from Cosmo Spens from CLOWD9 as he shares his insights and guidance on how organisations can get started on their ESG journey. Cosmo focuses on key points from the

A comprehensive look at why sustainability and ESG matters to the Payments industry; the three roles that the industry can play in moving the needle in the right direction; wording

Development of the EU Ecolabel criteria for financial products. Once developed, the criteria will be adopted through a Commission Decision under the EU Ecolabel Regulation.

The EU Ecolabel is an EU-wide label awarded to green products and services. A version of the label for retail financial products has been considered as an option to help

Supplement to the GHG Protocol Corporate Accounting and Reporting Standard

Reuters Events have published a decarbonization guidebook on “Delivering Effective Strategies for Net Zero Ambitions.” Created with ENGIE Impact, this report serves as a roadmap for achieving net zero emissions

Blog outlining how TSYS collaborated with ecolytiq to provide a green banking solution, which uses a proprietary algorithm and methodology that analyzes payment transactions in real time, giving transaction data

The FCA’s handbook includes a chapter on ESG and all the relevant obligations and reporting financial service firms must meet, including guidance on developing a Task Force on Climate-related Financial

A Corporate Accounting and Reporting Standard. The Greenhouse Gas Protocol Initiative is a multi-stakeholder partnership of businesses, non-governmental organizations (NGOs), governments, and others convened by the World Resources Institute (WRI),

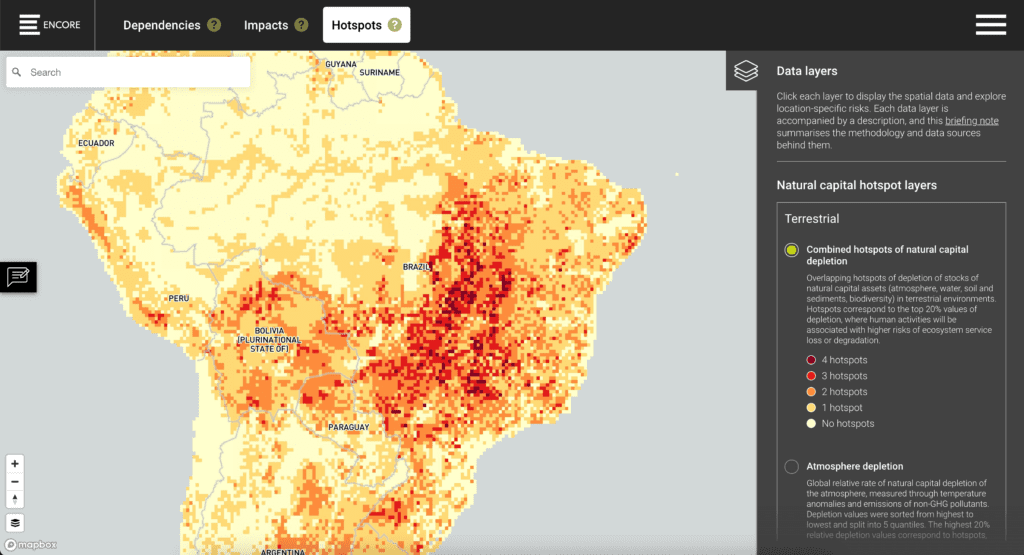

This Supplement is based on the framework of the Natural Capital Protocol, a standard decision-making process written for business, made up of four stages covering ‘why’, ‘what’, ‘how’, and ‘what

This report sets out the Bank’s latest thinking on climate-related risks and regulatory capital frameworks. The report includes updates on: capability and regime gaps; capitalisation timelines; and areas for future

Insights and case studies that focus on the core areas where Fintech will transform the approach to realising climate ambitions, shining a spotlight on some of the homegrown innovation that

Rebecca Speare-Cole at the Independent highlights how the UK may introduce measures against ‘Greenwashing’ in response to the International Sustainability Standards Board (ISSB) publication of its inaugural standards to help

Deloitte’s survey of more than 2,000 CxOs across 24 countries finds that the majority of CxOs remain optimistic the world will take sufficient steps to avoid the worst impacts of

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.