Merchant survey 2025: Navigating the payment innovation divide

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

What is this article about?

How fintechs are challenging traditional banks in the merchant services space, posing a threat to banks’ core business and revenue streams.

Why is it important?

The shift driven by fintechs could erode banks’ dominance, forcing them to modernise or risk losing a significant share of the market.

What’s next?

Banks must invest in modern, flexible technology and potentially partner with fintechs to remain competitive and retain their merchant relationships.

The landscape of merchant relationships is undergoing a profound transformation as fintech companies, driven by technological innovation, challenge the dominance long held by traditional banks. Companies like Stripe and Adyen are redefining merchant services by offering solutions that extend far beyond basic credit card processing. Their platforms provide diverse acceptance methods, integrated fraud prevention tools, advanced data analytics, and seamless payment routing, making them increasingly attractive to merchants. This shift is forcing banks to confront the growing threat of losing market share to these agile competitors.

Banks still hold the majority of merchant relationships and dominate acquiring market share in most regions, but their position is increasingly precarious. The rise of fintech solutions is siphoning away processing revenue and, crucially, settlement deposits—an essential source of affordable capital that supports lending and underpins banks’ core revenue streams. Despite these risks, the legacy banking sector has been slow to respond, potentially underestimating the gradual erosion of its market share.

Jan Von Vonno, Head of Industry & Wallets at Tink and leader of The Payments Association (TPA) open banking working group, underscores the challenge: “In response to the emergence of new fintech and as consumer expectations shifted, many large financial institutions adopted a shift towards technology—including partnering with fintech to benefit from their digital-first approach.” However, as Vonno points out, banks continue to grapple with regulatory constraints and scalability challenges, which hinder their ability to compete effectively with fintechs.

Consumer behaviour is also reshaping the competitive landscape. Vonno notes that over 28 million UK consumers—53%—hold two or more current accounts, reflecting a highly competitive retail banking market increasingly driven by customer experience. To keep pace, banks must address barriers such as meeting evolving consumer expectations and building expertise in advanced technologies. Vonno emphasizes that partnerships between banks and fintechs are critical to delivering seamless and innovative experiences for both consumers and businesses.

Ultimately, for traditional banks to maintain their competitive edge, they must embrace technology and collaborate with fintechs. By leveraging fintechs’ agility and digital expertise, banks can adapt to the evolving payments ecosystem and meet the rising expectations of merchants and consumers alike. Failure to do so risks further erosion of their market dominance and long-term viability.

The two main categories of service providers in the changing landscape of merchant relationships are the traditional banks and the fintech or merchant service providers. On one side, there are traditional banks, the long-standing high street incumbents that have historically provided banking services to businesses and individuals. Conversely, technology-driven companies offer slick, feature-rich payment acceptance platforms designed to meet the needs of modern, tech-savvy businesses.

The market share distribution between traditional banks and fintechs in the merchant services/acquiring space has evolved. Traditional banks continue to hold a significant portion of the market, with traditional commercial banking expected to dominate in the Americas with a projected market volume of US$546.37 billion in 2024. In Switzerland, however, traditional commercial banking is also projected to hold the largest market share, with an expected volume of US$40.07 billion in 2024.

These traditional banks have typically served as the go-to providers for merchant services, offering payment acceptance platforms and other financial products to their business customers. However, traditional banks have often been hampered by limited feature sets on their merchant acquiring platforms and onerous onboarding processes, making it difficult for merchants to quickly and easily integrate their payment solutions.

As a result, fintech companies are rapidly gaining ground. PayPal leads the online payment processing market with a 45% share, followed by Stripe at 17%. The fintech sector has seen remarkable growth, with the number of U.S. fintech companies reaching 10,412 by June 2024. Revenue in the U.S. fintech sector surpassed $39 billion in 2023 and is forecast to reach $70.5 billion by 2028.

The merchant services landscape has experienced a significant shift, with fintech companies increasingly dominating a space once controlled by traditional banks. Payments Consultancy Director Mark McMurtrie observes, “There has been a massive increase in the number of merchant service providers, and we’ve moved away from a place where banks used to be the main suppliers of merchant services and transitioned to a place where these services are provided more by technology companies, thanks to the increased complexity and the digital nature of payments.” This shift is also evident in the broader array of stakeholders now offering payment solutions to merchants.

Supporting this shift, Boston Consulting Group Principal Humza Samad explains how macroeconomic and consumer trends have catalysed the rise of non-bank payment service providers (PSPs): “We have seen non-bank PSPs build up in this area over the last ten years. Macro trends have been supportive in the UK with the e-commerce boom—over 25% of UK retail sales are now online—and cash-to-card conversion has expanded aggressively, peaking through Covid.” These factors, he notes, have provided fertile ground for fintechs to find niches where they outcompete incumbents through superior UI/UX, faster onboarding, developer-friendly APIs, and tailored servicing.

Fintech companies like Stripe, Revolut, and Monzo exemplify this transformation by delivering seamless onboarding, diverse payment options, and advanced fraud prevention tools—capabilities that often surpass those of traditional banks. Beyond payments, many fintechs have expanded into high-margin segments by offering bespoke software solutions designed for specific industries, often incorporating payments into the back end. “Propositions are focused on target segments,” Samad adds. “Small business banking propositions are another example. These segments offer greater margins, and we have seen the industry expand its focus from its commoditised core back-end processing to value-added services and other services beyond payments.”

By leveraging innovation and focusing on high-value market segments, fintechs are reshaping the competitive landscape of merchant services and payments, leaving traditional banks scrambling to adapt.

Fintechs have adopted a strategic playbook, starting with consumer-focused products and then expanding into merchant services. By building strong relationships with consumers through intuitive mobile apps and efficient onboarding, they position themselves to offer merchant services to the same audience, creating a natural progression into business banking. This two-pronged approach has allowed fintechs to carve out significant market share from traditional financial institutions.

The ability of fintechs to provide integrated, feature-rich solutions gives them a distinct advantage. Traditional banks often struggle with cumbersome onboarding processes and outdated platforms, while fintechs offer tailored, easy-to-use payment solutions that simplify financial management for merchants. McMurtrie’s point about the diversification of payment service providers is further underscored by the fact that many fintechs enable merchants to settle funds directly into either existing accounts at traditional banks or new accounts offered by fintech partner banks, reinforcing their influence across the ecosystem.

Moreover, fintechs have gained traction by targeting younger, tech-savvy businesses with superior user experiences. By establishing themselves as primary financial partners, these companies create opportunities to expand into value-added services like lending and financial management tools. This approach not only solidifies their foothold in the merchant services market but also positions them as formidable competitors to traditional banks, fundamentally reshaping the competitive landscape.

The traditional four-party model—consumers, merchants, acquirers, and issuers—remains foundational to the payments ecosystem, but its structure has evolved significantly. Payments Consultancy Director Mark McMurtrie highlights the emergence of diverse “merchant intermediaries,” including payment gateways, independent sales organisations (ISOs), software companies, shopping cart platforms, and payment orchestration platforms. These intermediaries have shifted the role of merchant integration away from banks and toward technology-driven entities, such as payment orchestration platforms that provide merchants with connections to multiple acquirers through a single interface. “This gives merchants flexibility and the best chance of success,” McMurtrie explains, underscoring how the ecosystem has expanded beyond traditional players.

This transformation is supported by broader market trends, including the e-commerce boom and the ongoing shift from cash to digital payments. These trends have allowed non-bank payment service providers (PSPs) to flourish. Samad points out that PSPs are excelling by focusing on underserved or high-value segments, particularly small and medium-sized businesses. He notes that many PSPs offer bespoke software tailored to specific industries, integrating payments as a back-end feature and expanding into areas such as small business banking. “By targeting these segments, PSPs deliver greater margins while moving beyond commoditised payment processing to value-added services,” Samad observes.

The result is a diversified payments ecosystem in which banks are no longer the sole players and fintechs are not the only disruptors. A wide range of intermediaries and technology providers now cater to merchants’ unique needs, reshaping the competitive landscape and driving innovation across the sector.

The importance of merchant services for traditional banks goes beyond just the revenue generated from the merchant-acquiring business itself. Merchant services play a crucial role in building business relationships and enabling banks to generate significant lending revenue.

At the core of traditional banking is the ability to lend money and earn interest on those loans. However, to lend effectively, banks need access to a stable and low-cost source of capital. This is where merchant deposits come into play. When merchants accept payments from their customers, those funds are typically deposited into the merchant’s bank account. These merchant deposits represent a cheap and reliable source of capital for banks, as they do not incur the same costs as borrowing from other financial institutions or the central bank.

By offering merchant services, banks are able to establish and maintain close relationships with businesses. These relationships allow banks to cross-sell other products and services, such as business loans, lines of credit, and cash management solutions. The revenue generated from these value-added services is where banks make the majority of their profits, far exceeding the margins earned from the merchant acquiring business itself.

However, according to McMurtrie, banks have little way back in this space as there has been a shift in power from banks to merchants. He states, “One of the most significant changes is that financial service providers can no longer impose on merchants how to pay. They have to respond to what the merchant is asking for, recognising that the merchant’s requests are coming from the end consumer.”

He adds: “The banks basically lost this game many years ago, and they didn’t lose it to fintech. They lost it to specialist payment processors.”

Furthermore, the data and insights banks gain from processing merchant transactions can be leveraged to make more informed lending decisions. By understanding their merchant clients’ cash flow patterns, sales volumes, and overall financial health, banks are better equipped to assess credit risk and offer tailored financing solutions. In essence, merchant services are not just a standalone revenue stream for banks but a critical enabler of their core lending business.

The loss of merchant deposits and associated relationships would significantly threaten the traditional banking model, undermining banks’ access to cheap capital and ability to generate revenue from lending and credit products.

Between 2017 and 2023, the value of deposits in both traditional and digital banks in the United Kingdom rose significantly. This growth is expected to continue until 2028. In 2023, traditional banks had around 4.95 trillion U.S. dollars in deposits, compared to about 2.7 trillion U.S. dollars for digital banks. Statista Financial Market Insights predicts that by 2027, digital banks will surpass traditional banks in total deposits.

This forecast aligns with the observed growth trajectory, as digital banks’ deposits have increased faster than traditional banks. By 2028, digital banks are expected to hold 5.18 trillion U.S. dollars in deposits, compared to 4.46 trillion U.S. dollars for traditional banks.

However, as fintechs continue to offer more compelling payment acceptance platforms and services to merchants, banks risk losing these valuable deposit funds. There are concerns however, that if they leave it long enough, they’ll hit a point of no return.

This loss of merchant deposits would pose an existential threat to banks, forcing them to rely on more expensive sources of capital, severely impacting their profitability and lending capabilities.

This shift is part of a global trend, with worldwide digital bank deposits projected to exceed 30 trillion U.S. dollars by 2028. The rise of digital banking is also evident in the fintech industry’s transaction value, which reached 1.2 trillion U.S. dollars in 2023 and is expected to surpass 2.3 trillion U.S. dollars by 2028.

This shift poses a serious challenge to traditional banks, particularly as fintechs and payment service providers (PSPs) increasingly capture merchant relationships. The resulting loss of merchant settlement deposits could undermine banks’ access to a critical source of cheap and stable funding. Samad highlights the importance of these deposits: “Settlement deposits are an important funding source for banks and benefit from ‘float,’ generating attractive returns on deposits based on overnight rates at the Bank of England.” Without these deposits, banks face higher funding costs, which could severely impact their profitability and lending capabilities.

While Samad notes that the loss of settlement deposits represents a “relatively smaller piece of the pie” compared to banks’ core deposit base from retail and business banking, the cumulative impact of digital banks, neobanks, and PSPs encroaching on deposit bases could become significant. “At scale, this trend could start to have implications on the cost of funding for credit creation, as deposits are a key source of cheap funding,” Samad explains.

Globally, the rise of digital banking is reshaping the financial landscape. Digital bank deposits are projected to exceed 30 trillion U.S. dollars by 2028, while the fintech industry’s transaction value, which reached 1.2 trillion U.S. dollars in 2023, is expected to more than double to 2.3 trillion U.S. dollars by 2028.

For traditional banks, the stakes are high. Without a strategic response to retain merchant relationships and counter the rise of fintechs, their ability to meet regulatory capital requirements and maintain lending operations could be jeopardized. This could mark an existential crisis for traditional banks, forcing them to reevaluate their role in a rapidly evolving financial ecosystem.

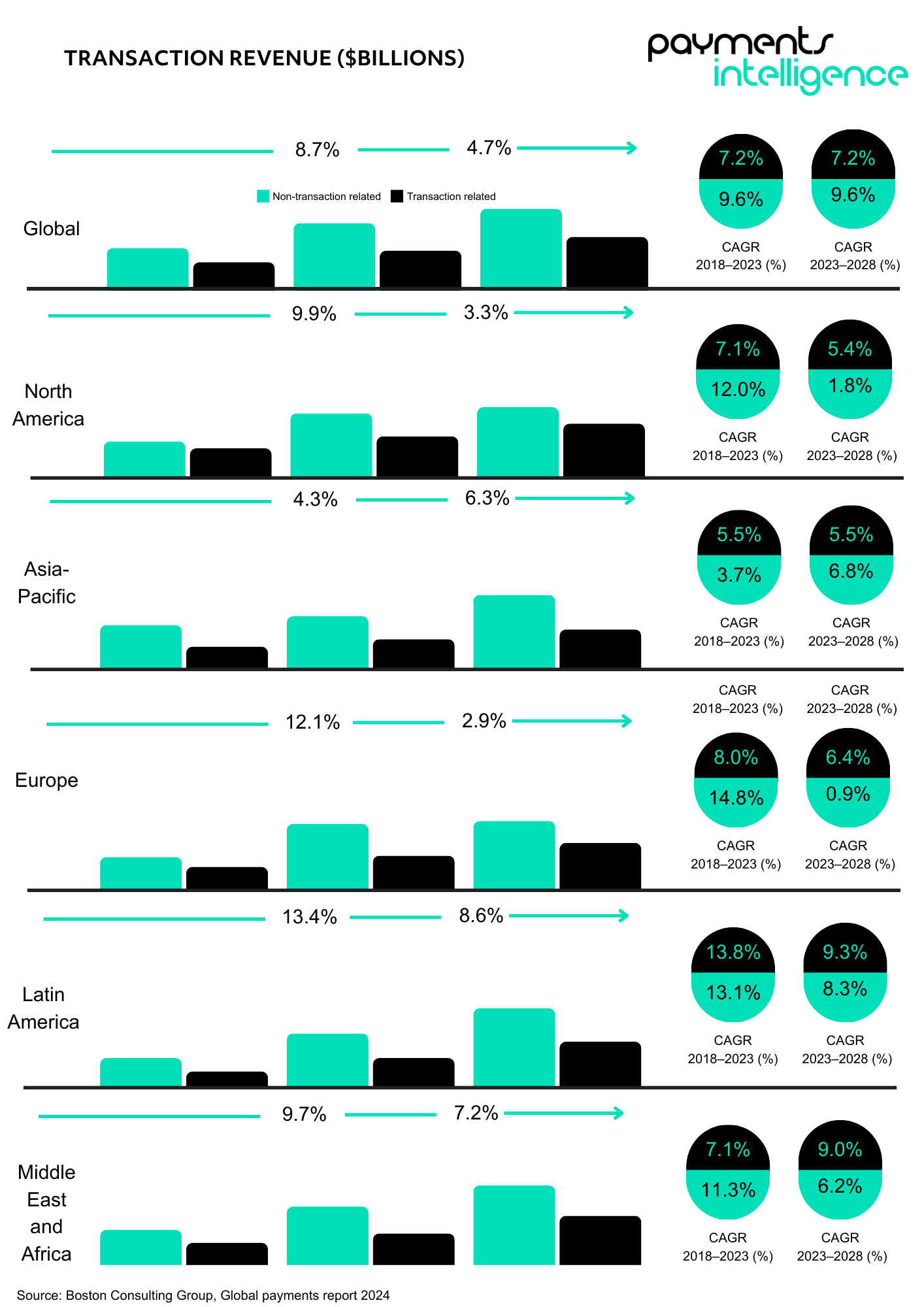

Another significant challenge facing the traditional banking sector is the growth of the payments market as a whole, which is currently outpacing the decline in traditional banks’ market share.

Although transaction volumes and deposits from a cohort of merchants at high street banks may rise yearly, they are not growing as quickly as the broader e-commerce market. Thus, while the market as a whole is increasing, banks are losing market share.

In essence, even though traditional banks might experience growth in the total value of payments and deposits from their merchant clients, that growth doesn’t match the swift expansion of the overall payments market.

As a result, banks are ceding market share to fintech companies that are capturing a larger portion of the growing payments landscape, leaving banks with a shrinking market segment. This dynamic can obscure the looming challenge for banks, as their revenues from merchant services may still be rising, yet their relative market position is gradually weakening.

Fintechs are gaining a compounding advantage over traditional banks as the power shifts in the payments and merchant services landscape. He explains that as fintechs continue to offer more and better services exponentially, they can create increasingly valuable platforms for merchants. These feature-rich payment acceptance platforms provide merchants with the advanced functionality and user experience they demand, such as support for buy-now-pay-later options, digital wallets, and sophisticated fraud prevention tools.

Additionally, as fintechs and tech providers move towards becoming deposit-taking institutions and offering superior credit products at competitive pricing, they can encroach on the lucrative revenue streams that have traditionally been the domain of banks. By having increased visibility into the full range of a merchant’s revenue sources and financial activities, fintechs can leverage data to make more accurate credit decisions and offer tailored financing solutions.

This compounding advantage creates a self-reinforcing cycle in which fintech attracts more merchants with its superior offerings, which in turn provides it with richer data and a greater ability to offer value-added services. Meanwhile, banks struggle to keep up, as their outdated technology and siloed operations make it difficult for them to match the agility and innovation of their fintech competitors.

This power shift represents a serious threat to the traditional banking model as fintechs steadily chip away at the banks’ merchant relationships and deposit base – the foundation of their core lending business. Unless banks can quickly modernise their capabilities and adopt a more holistic, tech-driven approach, they risk being relegated to a shrinking market segment, unable to compete with the compounding advantages enjoyed by the fintech challengers.

Additionally, bank leadership’s short-term, quarter-to-quarter focus, in contrast to the long-term, tech-led thinking of fintech founders, could be a contributing factor to the banks’ sluggish reaction.

The combination of capability limitations, organisational silos, and short-term leadership mentality has hindered traditional banks from recognising the urgency of the fintech threat and mounting an effective, coordinated response. Burdened by structural constraints and legacy systems, banks struggle to compete with the speed and agility of newer payment service providers (PSPs), which are reshaping customer expectations with innovative, tech-driven experiences.

According to Samad, traditional banks face a significant speed disadvantage compared to digital-native fintechs. Banks must contend with structural inefficiencies, legacy systems, and technical debt, all of which give fintechs a clear advantage in speed-to-market. Furthermore, the regulatory environment has historically favoured the more nimble fintechs over legacy banks, further widening the gap.

Looking ahead, many banks are turning to partnerships and acquisitions to remain competitive rather than attempting to transform their core operations quickly enough to keep pace. By collaborating with or acquiring fintechs, banks hope to leverage their innovation and agility while circumventing the challenges posed by legacy systems.

In light of the difficult road ahead of traditional banks, if the situation remains the same, banking institutions will need to modernise their payment stacks and underlying technology to stay competitive against the agile fintech players disrupting the merchant services space.

Banks have historically struggled with building their cutting-edge technology, often relying on outdated systems and outsourcing their payment processing capabilities. This technological capability gap has allowed fintechs to swoop in and offer merchants far more feature-rich, user-friendly payment acceptance platforms. Merchants, particularly those in the small to medium enterprise segment, have quickly adopted these fintech solutions, lured by the slick interfaces, seamless onboarding, and innovative payment methods they provide.

Samad also notes that the banks’ slow decision-making and structural constraints make it difficult for them to innovate quickly enough: “But the reality is, it just takes time. And the question is, will they able to evolve quickly enough?”

For banks to claw back market share and retain their valuable merchant relationships, they must prioritise modernising their payment stacks and investing in modern, cloud-based payment processing infrastructure that can match the agility and functionality of fintech offerings.

Banks need to rapidly integrate new payment methods, provide robust fraud prevention tools, and offer merchants a level of customisation and flexibility that has traditionally been lacking in their legacy systems.

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

The Bank of England’s offline CBDC trials show it’s technically possible—but device limits, fraud risks, and policy gaps must still be solved.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.