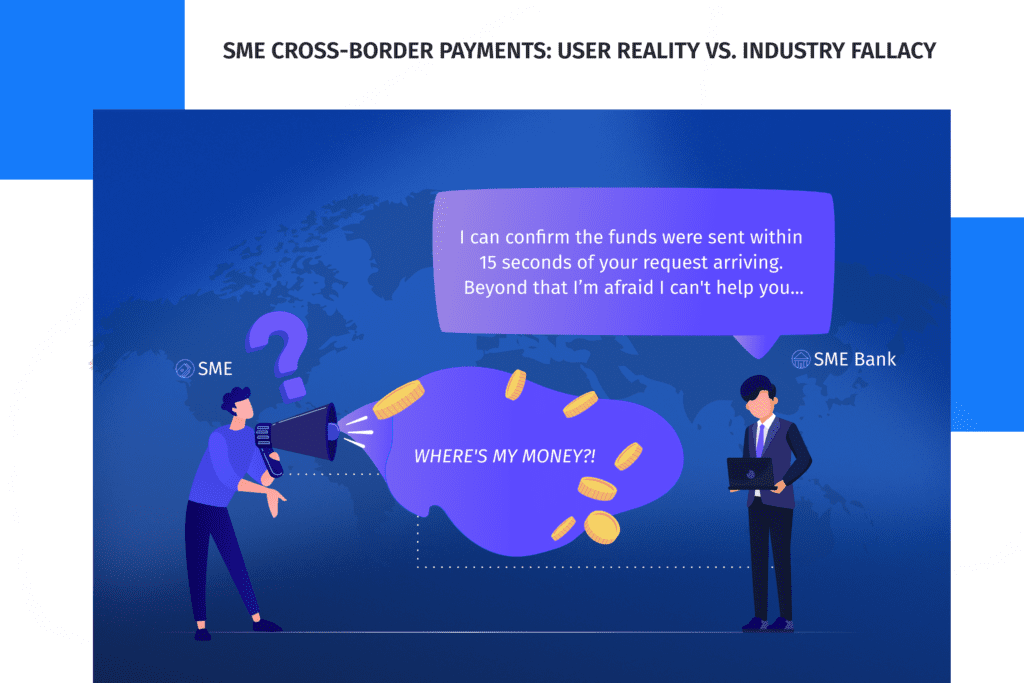

Cross-border payments, the lifeblood of global commerce, are also an Achilles heel for most economies globally—both emerging and developed. This vulnerability is no better exemplified than by the failure of the finance and payments industry to resolve the challenges of its most underappreciated and undervalued segment: SMEs.

Our latest white paper, User Reality vs. Industry Fallacy, focuses on the plight of small and medium-sized enterprises as they struggle to grow and trade internationally. Numbering more than 330 million worldwide, SMEs’ needs continue to be.

Why read this paper?

Below, we set out three of the most interesting takeaways from the paper to whet the appetite of industry stakeholders. Other critical topics explored within the paper but not illustrated here include why CBDCs are not the answer, how much should be learned from the consumer payments world, and why correspondent banks have not lost the battle yet.

High on SMEs’ wish lists, we also delve into areas including the need to deliver flexible payment destinations and mass/bulk payments, identifying the status of a payment and delivery confirmation, and transaction reporting. Now, on to the appetizer….

Optically, SMEs’ lowly 7% share of cross-border B2B volumes suggests that they are an unimportant segment. This is wrong. As a share of revenues, this proportion skyrockets to 40%.

Another way of highlighting this misconception, as Mastercard data shows, is to understand the spending and revenue generation of SMEs – a $50 trillion annual spending pot. Address these needs, and the upside for all stakeholders is clear. SMEs can easily be more profitable payments customers than consumer payments.

More than one third of SMEs globally have experienced issues leading to late or failed payment. The majority of these are addressable with existing or emerging technologies. These delays and failures deprive SMEs of billions of dollars of liquidity annually.

SMEs are vital for social and economic change, and this applies as equally to all developed as well as developing and emerging economies. Employment in the EU, for example, is more than two-thirds skewed to SMEs.

Only 40% of businesses are paid on time, but these easily avoidable delays cause at least a quarter of all bankruptcies.

Download, digest & debate

The paper’s interactive format, with video interview excerpts and links to useful data and other reading, ensure that the topics introduced are only the start of this debate.

To explore the many opportunities and solutions that software and technology are creating on a daily basis, download, digest and debate ‘User Reality vs. Industry Fallacy’. Join this debate, hear and see the experts discuss what matters and why and enter a world of relevant opinion and data.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.