At Skipify, our vision is simple: provide shoppers the ultimate choice and flexibility at checkout. Whether paying with a credit or debit card, splitting payments across cards, or using alternative financing options, we believe in empowering consumers at the moment of purchase with every payment method possible. Powered by Skipify’s Commerce Identity Cloud, merchants can now offer a wide range of payment options seamlessly — without any upheavals to their existing checkout experience.

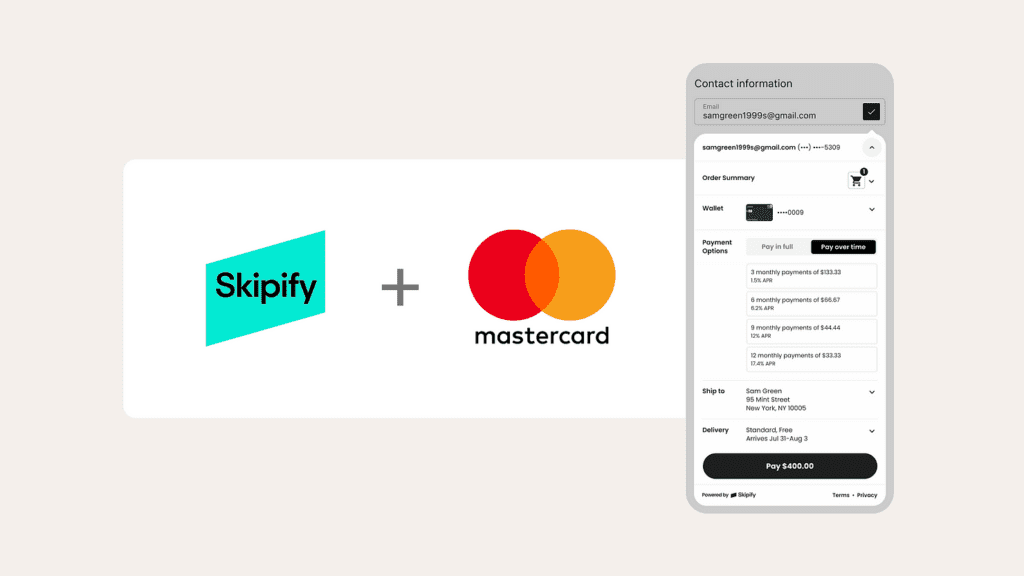

Mastercard has selected Skipify to expand its US instalments program, providing more payment flexibility directly at checkout. Eligible cardholders and Mastercard users can access instalment options for any eligible credit card, making purchases easier and more flexible than ever.

Skipify leverages digital identity to recognize shoppers at checkout instantly. It automatically displays all their associated cards and any eligible instalment payment options — no manual entry, no logins, and no hassle required. Eligible shoppers can pay in full with their preferred card or split the purchase into an instalment plan. Skipify will work behind the scenes with Mastercard to ensure the entire process is fast and secure, positively impacting authorization and conversion rates. This seamless experience translates to larger purchase values and higher conversion rates for merchants without adding friction to the checkout user experience.

Installment payments are available to Skipify merchants at no additional cost, offering significant savings compared to traditional BNPL solutions, which typically charge service fees ranging from 2% to 8%.

As consumers increasingly turn to buy-now-pay-later (BNPL) options to fund their purchases and manage spending, offering financing options has become crucial for merchants to acquire customers and build brand loyalty.

Integrating BNPL services, however, often presents significant challenges. Merchants face expensive, complex setups, juggling multiple provider contracts and navigating inconsistent operational procedures. These obstacles create a disjointed user experience and add friction to the purchase process—especially when consumers are already frustrated with complicated checkout pages, redirects, and too many payment buttons.

In contrast, card-linked instalments have gained significant traction, with 33% of consumers now choosing credit card-linked instalments for big-ticket purchases—more than any other pay-later option.1 As always, consumer trust plays a major role in adoption. 63% of consumers say they are more likely to adopt BNPL if their trusted banking partner offers them.2 Yet, many of these options are only available post-purchase, allowing consumers to repay their credit card purchases in instalments after the fact until now.

Skipify and Mastercard empower shoppers with a new level of confidence and freedom at checkout. Instant access to instalment options allows consumers to manage their budgets effortlessly, removing barriers and making shopping easier, more intuitive, and free from financial constraints.

Jeff Smith, SVP of strategic partnerships at Skipify, says, “At Skipify, we’re committed to making checkout experiences more flexible, intuitive, and shopper-friendly. Our collaboration with Mastercard allows us to integrate instalment options seamlessly into the shopping journey, eliminating barriers and enhancing convenience. We are excited to help Mastercard deliver this product at scale across our many merchants, bringing even more choice to shoppers while enabling customers to offer flexibility more simply and cost-effectively than ever. Together, we’re empowering consumers and driving greater value for businesses.”

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.