Optimus, a leading regulated technology company specialising in payment solutions, is set for significant growth in 2025. With a revamped commercial strategy and an unwavering commitment to customer-centric solutions, Optimus is primed to solidify its position as a key player in the payments industry. The company’s planned expansion into the European market later this year will mark a significant milestone in its growth trajectory.

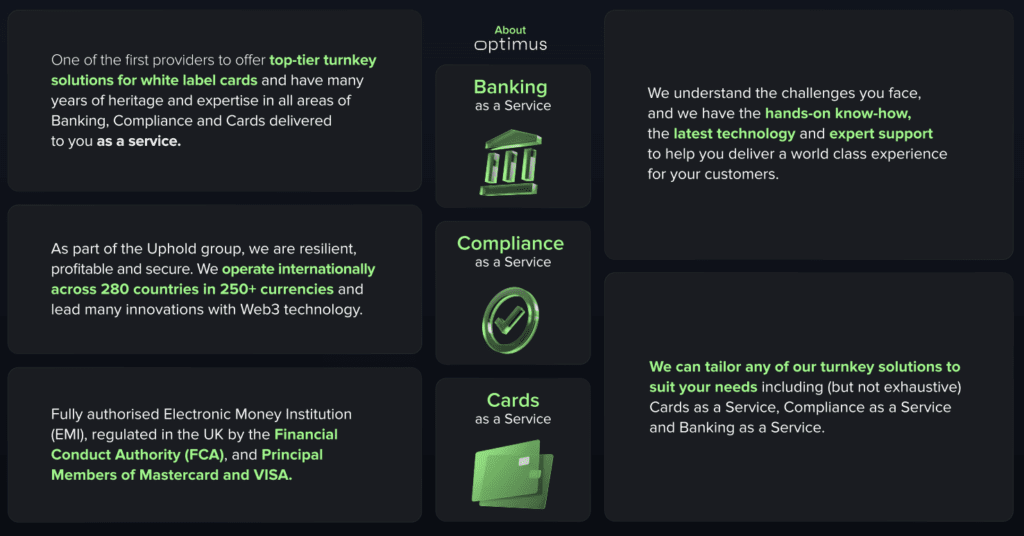

At the upcoming PAY360 event, Optimus’s leadership team, including CEO Nick Charteris, Commercial Director Oli Middleton, and Michelle Millsop, will unveil the company’s ambitious commercial strategy. Optimus’s success is underpinned by three core product offerings:

Optimus caters to a diverse clientele, including businesses operating in the digital assets, fintech/traditional finance, and gaming sectors. By providing a comprehensive suite of payment services, Optimus empowers businesses to optimise their payment processes, enhance customer experiences, and drive growth.

Optimus’s e-money license and advanced core banking/card processing technology platforms provide a solid foundation for its continued success. These assets, combined with the company’s innovative approach and customer-centric focus, position Optimus to capitalise on emerging opportunities in the dynamic payments landscape.

The PAY360 event will serve as a platform for Optimus to engage with key stakeholders, gain valuable market insights, and showcase its capabilities. As Optimus plans to expand its footprint into the European market, the company is poised to leverage its strengths, forge strategic partnerships, and deliver exceptional value to its clients. With its robust technology infrastructure, diverse product offerings, and unwavering commitment to innovation, Optimus is well-equipped to navigate the complexities of the payments industry and achieve sustainable growth in the years to come.

The PAY360 Event provides an opportunity for Optimus to engage with key stakeholders, gain insights into market trends, and position itself for future expansion. With a commitment to excellence and a focus on delivering exceptional customer experiences, Optimus is well-positioned to capitalise on the opportunities presented by its new commercial strategy.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.