PSD3 and PSR will guide and inspire UK banks and financial institutions to react proactively to upcoming changes. They should invest in robust business and technology architectures to make sure they remain competitive and provide consumer centric solutions. In this environment, knowledge is key to future success and participants need successful solutions that cover the full payments value chain in order to remain both compliant and competitive.

The payments ecosystem in the UK and EU is in constant flux, driven by regulatory guidance and technological advances.

In the UK, consumers and businesses make around 1,500 transactions every second. The government aims to simultaneously boost the economy and drive innovation in payments, via the National Payments Vision and Strategy, which has been shaped by views and inputs of over 100 financial institutions.

The EU aims to harmonize payments, enhance transaction security, and promote competition within the European Economic Area. PSD3 and PSR are the latest initiatives driving these goals.

PSD3 builds on PSD2 by clarifying regulations, expanding bank liability, and introducing stricter IT and risk standards. It emphasises strong customer authentication and transaction transparency.

The PSR (Payment Service Regulation) complements the Payment Service Directive, leading to directly applicable law in all EU states.

Although PSD3 won’t directly impact the UK, it’s expected to inspire UK regulators and industry leaders, fostering competition. Understanding these changes is key to keeping the UK competitive.

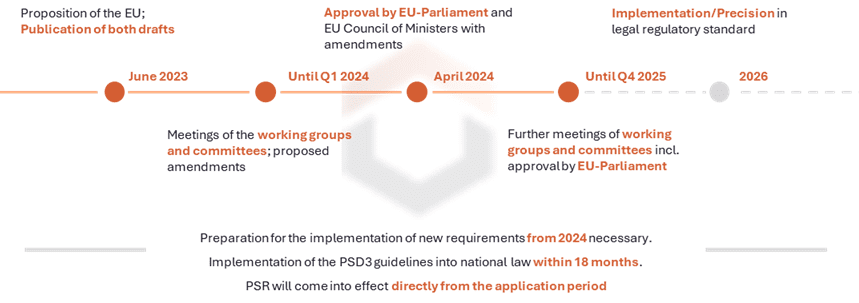

The revised regulations on strong customer authentication and liability rules are significant. Ongoing negotiations between the European Parliament and Council will finalize the text by late 2024, with implementation expected in 2026.

PSD3 implementation schedule (2023-2026):

The new PSD3 requirements will particularly impact the following areas:

Following the UK’s adoption of SCA-RTS by the FCA in 2019, the EU regulations offer an opportunity to implement more secure and consumer-friendly standards.

In October 2024, the UK introduced new APP Fraud regulations, splitting reimbursement responsibility 50/50 between sending and receiving PSPs.

In the UK, all PSPs need to mandatorily register in the Reimbursement Claims Management System (RCMS) for tracking and claim management.

CHAPS is also included with the rules aligning with CHAPS participants and a provision of 24/5 reimbursement for PSPs in the CHAPS System.

To stay competitive and profitable, banks and payment service providers must proactively comply with new regulations to secure early compliance.

To summarise, PSD3 and PSR will guide and inspire UK banks and financial institutions to react proactively to upcoming changes. They should invest in robust business and technology architectures to make sure they remain competitive and provide consumer centric solutions.

In this environment, knowledge is key to future success and participants need successful solutions that cover the full payments value chain in order to remain both compliant and competitive.

About Projective Group:

Projective Group is a leading financial services change specialist with expertise in strategy, data, payments, risk and compliance, transformation, and talent. Our combined expertise ensures that clients are supported by domain specialists throughout all phases of their change journey. The Payments Practice addresses the latest banking sector developments, including building new market infrastructures, core banking replacement, and the introduction of instant and open banking.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.