The Financial Crime 360 survey reveals how the industry is tackling evolving threats like AI-driven fraud, emphasising the need for collaboration, innovation, and updated regulations to effectively combat financial crime in 2024

The Financial Crime 360 (FC360) survey provides a comprehensive and nuanced analysis of the current landscape in financial crime prevention, drawing on the perspectives of a diverse group of stakeholders within the payments ecosystem.

The survey highlights the multifaceted challenges the industry faces, from traditional fraud to the rising threats posed by AI-driven attacks. It also underscores the strategic responses implemented across the sector, reflecting a proactive approach to mitigating financial crime.

Several key factors shape the financial crime landscape. The global economic downturn, geopolitical instability, and rapid technological advancements create new challenges and opportunities for financial institutions. The convergence of cybercrime and money laundering, the rising cost of compliance, and the need for highly skilled teams are central themes in the current state of financial crime. As the payments landscape evolves, becoming more complex and digitised, financial crime teams must be increasingly alert, responsive, and agile to counter emerging threats and navigate unforeseen disturbances. This dynamic environment necessitates a multifaceted approach to fighting financial crime involving advanced technologies, robust regulatory frameworks, and continuous collaboration across the industry.

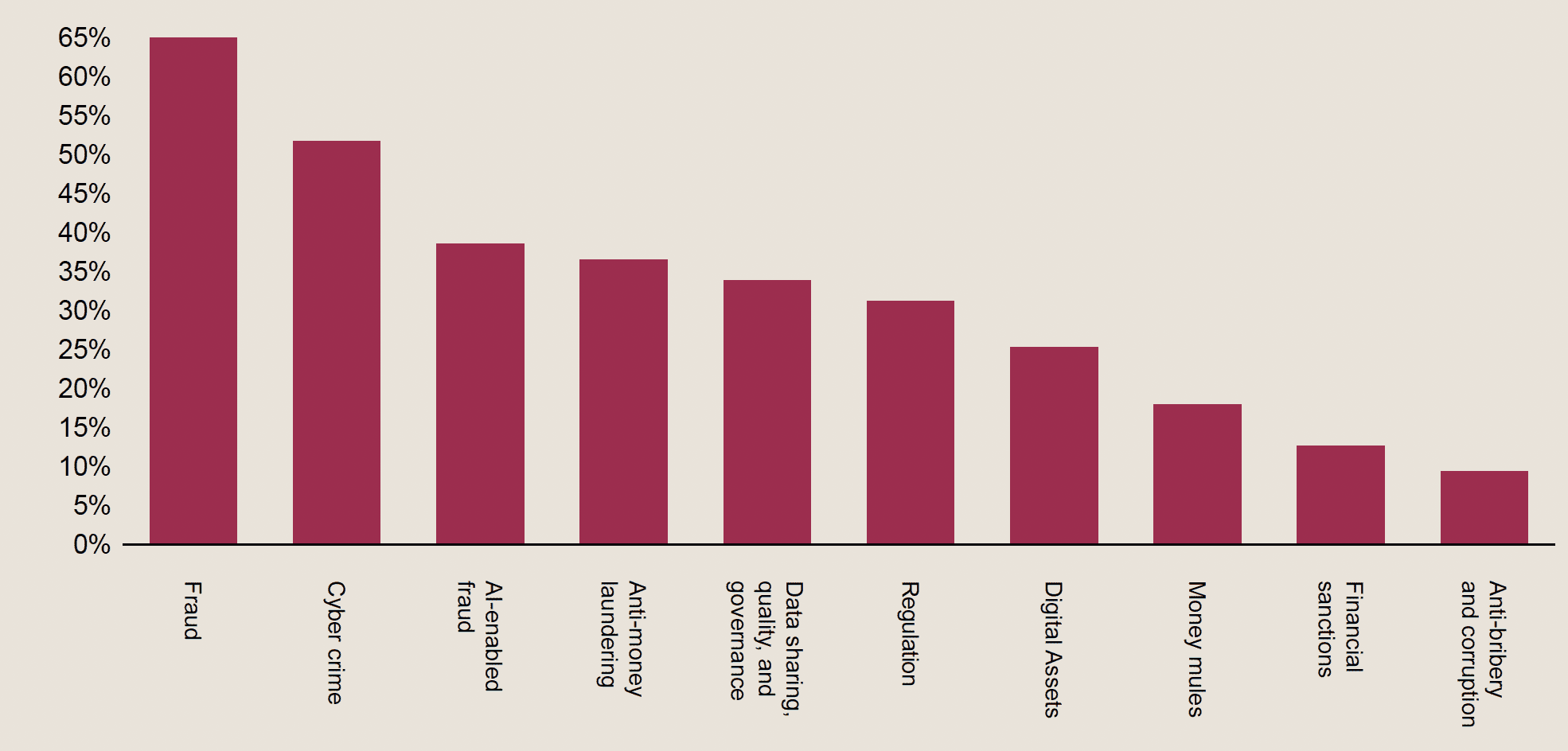

Financial crime remains a critical issue for businesses, with fraud identified as the top concern by 65% of respondents. This is followed by the growing threats of cybercrime (52%) and AI-enabled fraud (38%), underscoring the increasingly sophisticated nature of financial crime. Identity fraud is particularly prevalent, affecting 42% of respondents, and continues to be a significant challenge for the industry. Other issues, such as anti-money laundering (AML) and the quality and governance of data sharing, are also critical, with 36% and 34% of businesses struggling in these areas. The rise of authorised push payment (APP) fraud and AI-driven threats, including identity deepfakes (56%) and automated personal data collection (32%), highlights the evolving landscape of financial crime, demanding heightened vigilance and innovation in prevention strategies.

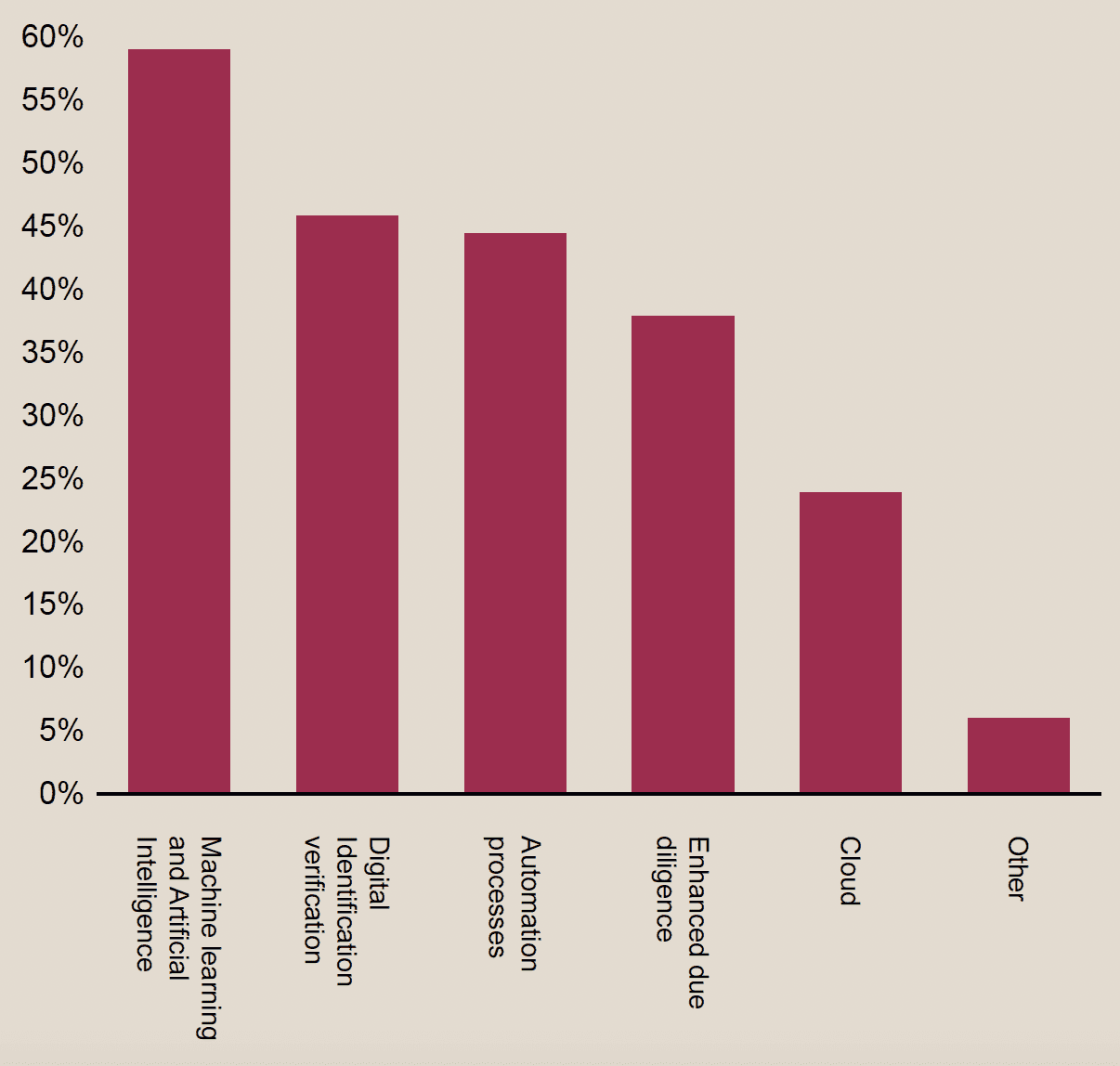

In response to these challenges, companies are ramping up their investments in cutting-edge technologies, with 59% prioritising machine learning and AI,, 46% focusing on digital identification verification, and 44% on automation processes.

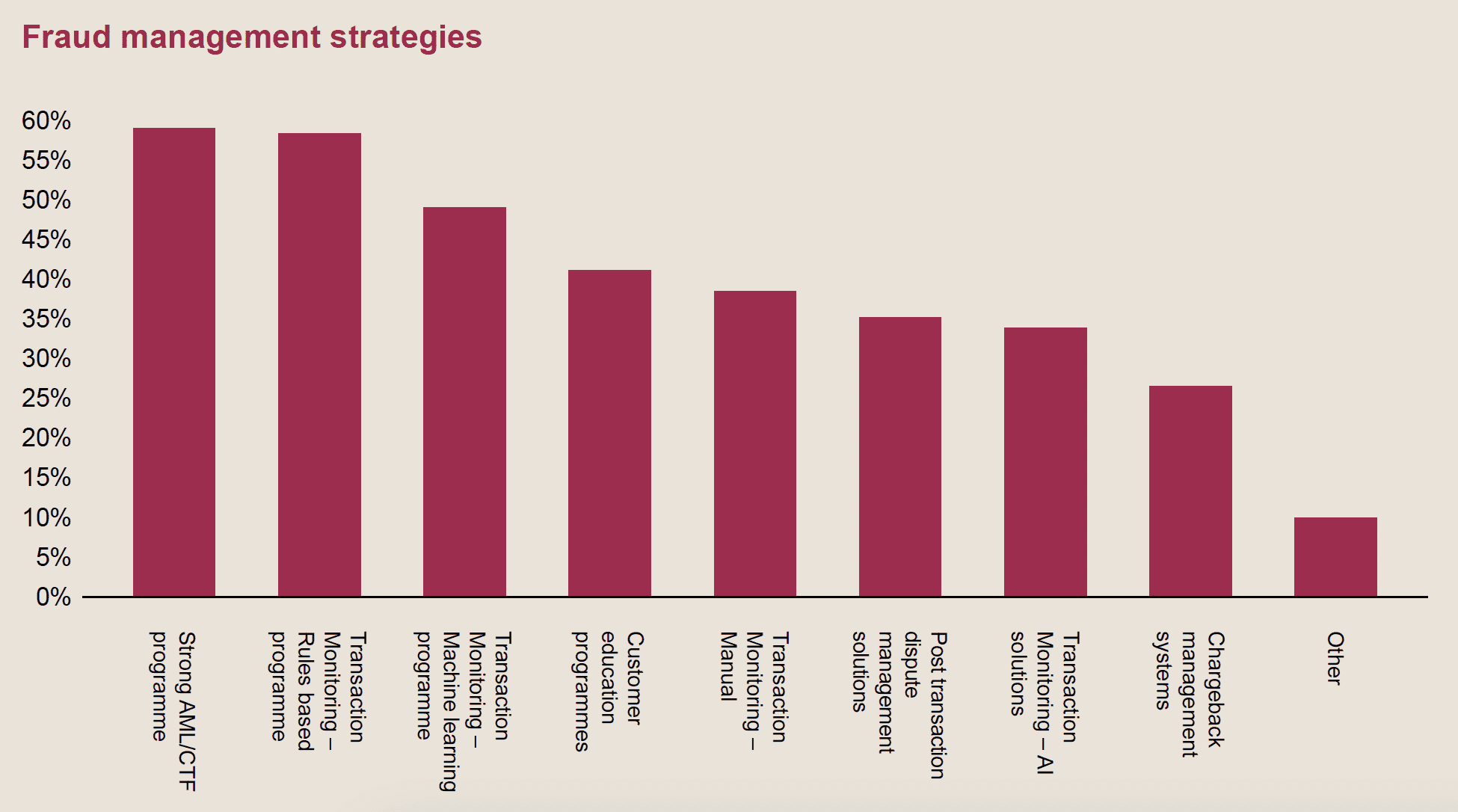

The emphasis on real-time transaction monitoring is also significant, with 34% of businesses rating their preparedness in this area as very high. Fraud prevention strategies are robust, with 59% of companies implementing strong AML/CTF programmes and a considerable number leveraging both rules-based (58%) and machine learning-based (49%) transaction monitoring systems. Additionally, customer education has become a focal point, with 41% of companies investing in programmes to better inform their clients about fraud risks. Financial investment in these areas is substantial, with nearly half of the respondents reporting spending between £50,000 and £500,000 on financial crime-related initiatives in 2023 and 30% planning to increase this spending in the coming year. Industry collaboration and staying updated through reports, conferences, and media are key to maintaining a strong defence against these threats. However, opinions are split on the adequacy of the UK’s fraud regulations, with 51% viewing them as fit for purpose, while 49% believe that regulatory updates are necessary to keep pace with the rapidly evolving threat landscape.

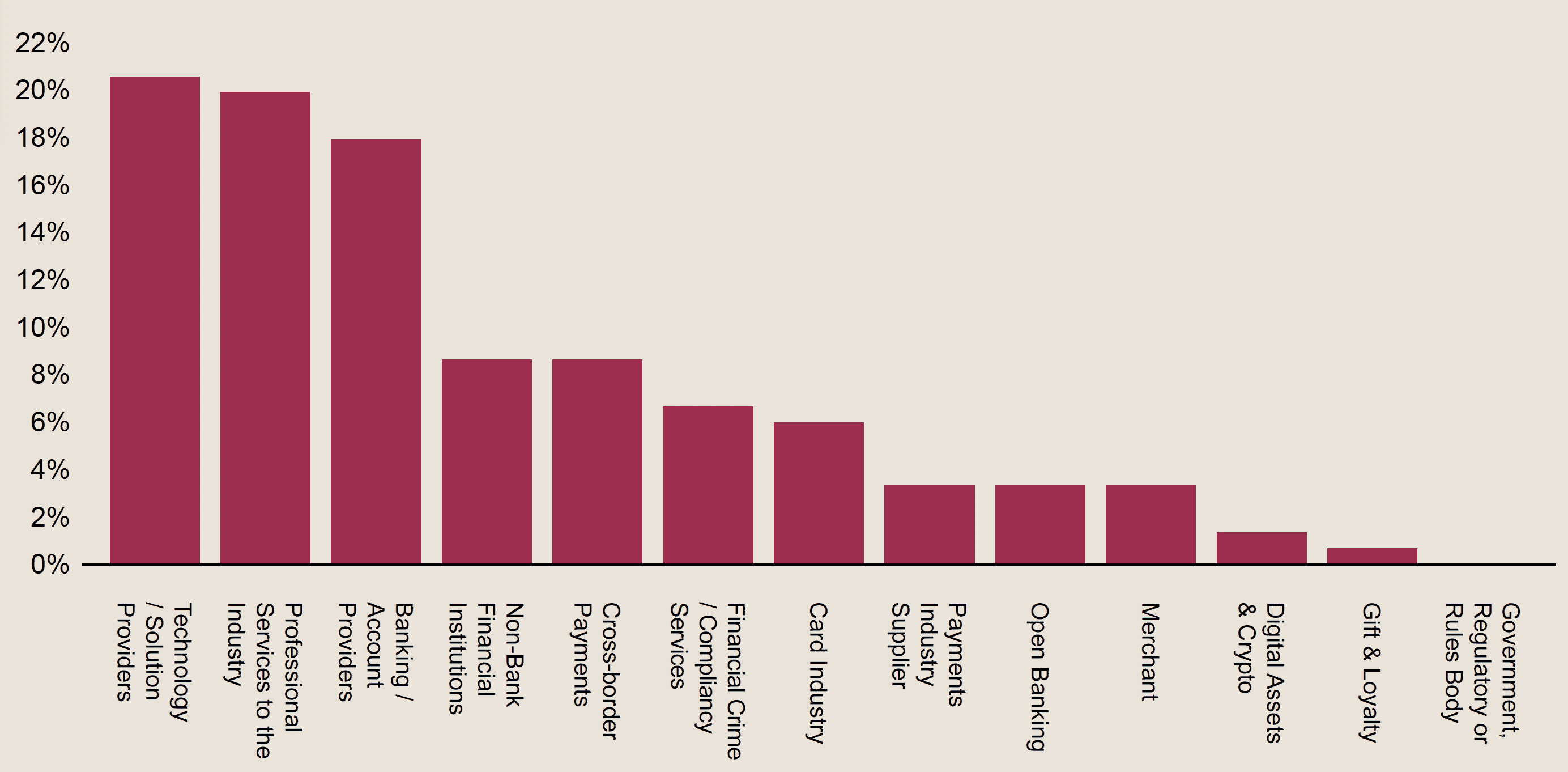

The survey highlights the diverse representation across the payments and fintech ecosystem. Technology and solution providers lead with 21%, followed closely by professional services to the industry at 20% and banking/ account providers at 18%. This diverse participation indicates a broad and vested interest in addressing financial crime from various perspectives, emphasising the ecosystem’s multifaceted approach to combating fraud.

Fraud remains the dominant concern, cited by 65% of respondents as the most significant challenge in the coming year. This persistent threat is closely followed by cybercrime, which concerns 52% of participants, and AI-enabled fraud, which 38% identified as a significant issue. Additionally, anti-money laundering (36%) and the quality and governance of data sharing (34%) are highlighted, underscoring the critical need for robust regulatory frameworks and improved data management practices

Financial crime, particularly fraud, remains a critical concern for the payments industry. As APP and identity fraud challenges persist, firms must navigate a stringent AML regulatory environment and a volatile sanctions landscape. The new Labour Government is expected to clarify the regulatory framework, requiring businesses to be agile. Firms must stay ahead of regulatory changes, adopt cutting-edge technologies like GenAI, and collaborate to enhance their ability to prevent, detect, and respond to financial crime.

Clarinda Woodford associate director, economic crime advisory BDO UK LLP

According to the survey, 42% of respondents report identity fraud as the most common type of fraud, which indicates a critical area for enhanced identity verification measures. The significant percentage of ‘other’ (28%) suggests the emergence of various fraud typologies that require adaptive and comprehensive detection strategies. Misuse of facility (13%) and facility takeover (12%) further highlight the vulnerabilities within financial infrastructures that fraudsters exploit.

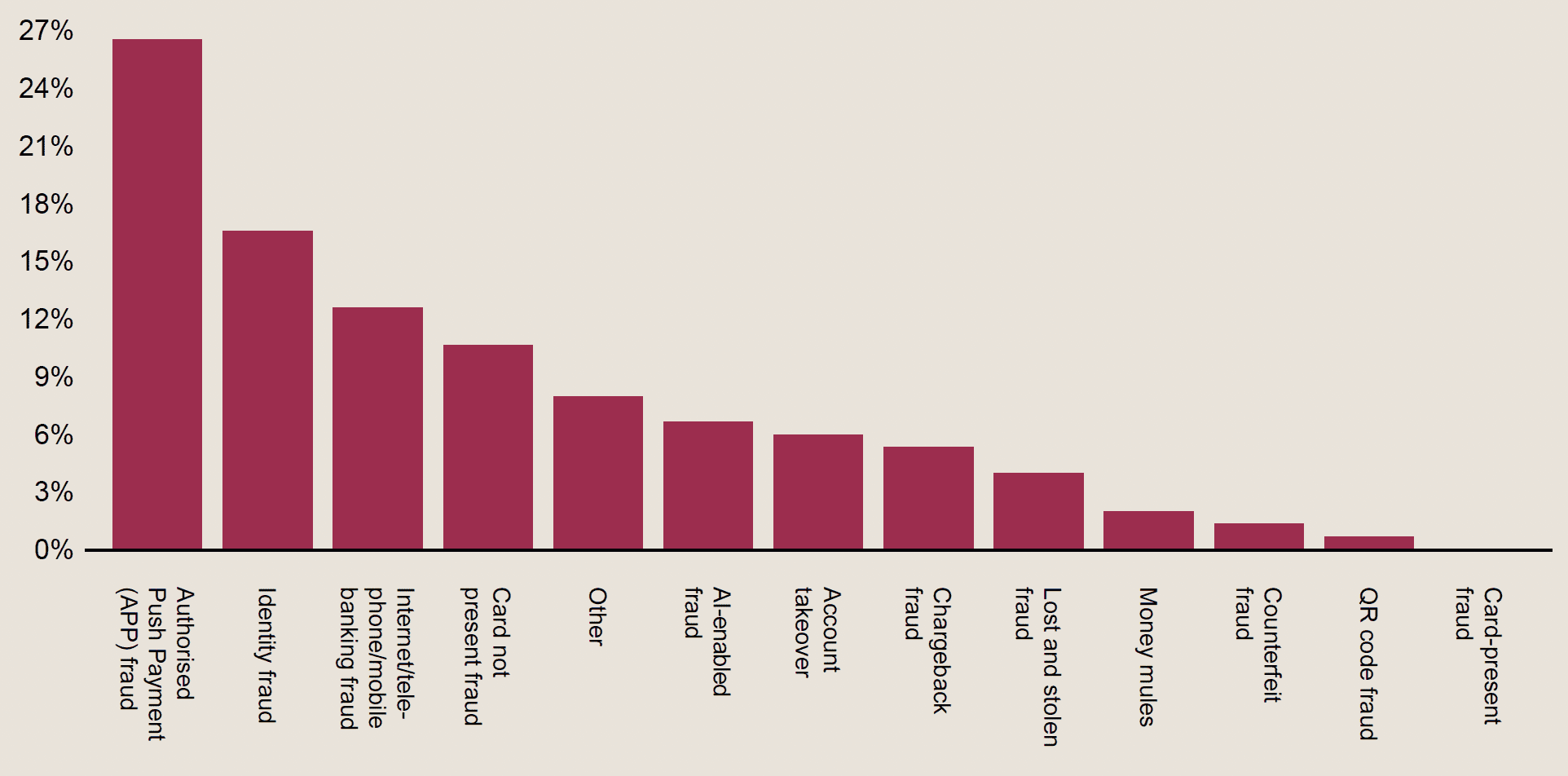

Authorised push payment (APP) fraud leads at 26%, showcasing the sophisticated nature of scams targeting direct customer payments. Identity fraud (17%) and internet/telephone/mobile banking fraud (13%) further illustrate the digital shift in fraudulent activities. The presence of AI-enabled fraud (7%) and chargeback fraud (5%) highlights the complexity and breadth of threats facing businesses today, necessitating a multifaceted approach to fraud prevention.

The survey reveals significant concerns over AI-driven fraud, with identity deepfakes perceived as the most significant threat by 56% of respondents. Automated personal data collection (32%) also stands out as a notable threat, indicating the risks associated with large-scale, automated harvesting of personal information for fraudulent purposes. Chatbot-powered fraud is another AI-driven fraud threat, highlighted by 9% of respondents.

A significant majority (59%) are aware of the new APP rules proposed by the Payment Systems Regulator (PSR), reflecting industry readiness to adapt to regulatory changes. Among those aware, 70% plan to implement a combination of measures, demonstrating a comprehensive approach to fraud prevention. Reviewing transactions and limiting them based on a maximum cap (19%) and focusing on the sending bank/PI/EMI (18%) are targeted efforts to mitigate risks.

Investment in advanced technologies is a clear priority, with machine learning and AI leading at 59%, followed by digital identification verification (46%) and automation processes (44%). This strategic focus on leveraging innovation for fraud detection and prevention reflects an industry-wide shift towards more sophisticated technological solutions.

There is a notable lack of consensus on acceptable fraud loss levels, with 48% of respondents unsure. However, 41% believe it should be less than half a billion pounds annually, reflecting a significant concern for minimising financial losses due to fraud. This uncertainty highlights the need for clearer benchmarks and more uniform standards across the industry.

Financial crimes, including fraud, remain a major concern for institutions globally. The evolving nature of criminal technology exploitation challenges firms seeking value from their investments. Regulatory demands on smaller firms hinder competition in the payments market, making data analytics and collaboration essential for combating financial crime. Government and regulatory leadership, possibly through appointing a Minister for Economic Crime and fostering a collaborative data analytics ecosystem, could drive significant improvements and support much-needed economic growth.

Jane Jee, ambassador and financial crime working lead The Payments Association

The survey assesses readiness for various technologies:

Respondents suggest that vendors should:

The Financial Crime 360 survey highlights that fraud dominates the agenda this year. Notably, 59% of firms see robust AML/ CTF programmes as essential in fraud prevention, underscoring the alignment of fraud and AML risk management. The survey also points to significant investments in AI, digital ID verification, and automation technologies, which present substantial opportunities for improving operational efficiency and enhancing the detection of suspicious activities.

Jessica Cath, head of financial crime Thistle Initiatives

Opinions are divided on the effectiveness of the UK’s fraud regulation, with 51% considering it fit for purpose and 49% calling for updates. Those advocating for updates emphasise the need for AI regulation, more filters to prevent fraud attacks, and dynamic, intelligence-led fraud detection solutions. This split opinion underscores the dynamic nature of financial crime and the necessity for regulatory frameworks to evolve continually.

Strong AML/CTF programmes (59%) and transaction monitoring systems (rules-based: 58%, machine learning: 49%) are widely deployed, demonstrating the industry’s commitment to comprehensive fraud prevention strategies. Customer education programmes (41%) also play a significant role in these efforts, highlighting the importance of informed and vigilant consumers in the fight against fraud.

A significant portion of respondents (48%) reported spending between £50,000 and £500,000 on financial crime-related initiatives in 2023. A quarter of the respondents (24%) reported heavy investment, with expenditures ranging between £500,000 and £10,000,000. Additionally, 25% selected ‘other’, while a smaller segment (3%) invested more than £10,000,000, reflecting a wide range of financial commitments to combating financial crime across different organisations.

Responses regarding the industry’s optimism in curbing economic crime are varied, with 40% positive and 40% neutral, indicating cautious optimism. Only 6% are very positive, reflecting the significant challenges in addressing evolving fraud threats. The industry’s ongoing interest in improving crime prevention measures, even if driven by self-interest, is driving advancements that make committing fraud more difficult.

In the next 12 months, 30% of organisations plan to increase their spending on fraud prevention by up to 25%, reflecting a proactive approach to strengthening fraud prevention measures. Additionally, 10% expect to increase their investment by more than 25, while 22% plan to maintain current spending levels. A further 22% are uncertain about their future investment, and 17% fall into the ‘other’ category.

The industry relies heavily on industry reports (81%), conferences (71%), and industry media (68%). Collaboration with financial institutions (57%), and law enforcement agencies (44%) also plays crucial roles in staying informed. Other sources contribute minimally, indicating a preference for established, formal channels of information over less conventional sources.

AI is increasingly being used in financial crime, tricking individuals into transferring money to criminals. Traditional methods like MFA and biometrics may not prevent this type of fraud. The focus must shift towards improving transaction monitoring to detect and stop AI-driven fraud. A combined approach, leveraging AI for pattern detection and human resources for rapid response to emerging threats, is crucial in combating this evolving risk, particularly in combating authorised push payments (APP) fraud.

John Erik Setsaas, director of innovation, Tietoevry Banking - Financial Crime Prevention

As financial crime grows in complexity, the findings from the FC360 survey underscore the urgent need for a robust, multi-faceted approach. The industry must not only adopt advanced technologies like AI and real-time monitoring but also ensure these tools are effectively integrated into existing systems. This technological adoption should be complemented by strong regulatory compliance and a commitment to continuous learning and adaptation.

Collaboration across the financial ecosystem is crucial. Sharing knowledge and best practices will strengthen our collective ability to detect and respond to emerging threats. Improved data sharing and analytics capabilities will be key to quickly identifying and addressing vulnerabilities.

The evolving nature of financial crime also necessitates a dynamic regulatory environment. With opinions divided on the adequacy of current UK fraud regulations, there’s a clear need for updated frameworks to keep pace with technological advancements. Enhanced regulatory leadership, possibly through roles dedicated to economic crime, could drive meaningful progress.

Customer education remains a vital component of fraud prevention. As fraud tactics become more sophisticated, empowering customers with the knowledge to protect themselves will bolster the overall security of financial systems.

In the face of these challenges, the financial industry must remain vigilant, agile, and collaborative. By aligning technological innovation, regulatory support, and industry cooperation, we can significantly strengthen our defences against financial crime and navigate the threats of the future.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.