Do you want to swallow the blue pill or the red pill? The crypto fraternity weighed in favor of the red pill and here we have the Bitcoin ETF live and exploding. What’s the result? In the last 3 days ever since the passing of the ETF, more than 21,000 BTCs have been pumped into the crypto space at a staggering amount of $894 million. So, it wouldn’t be an understatement to say that the litmus test has been successful and we could have more proponents competing for dominance and ETH remains as the leader of the pack.

Yeah, you heard that right. Ethereum ETF will be the next big thing to watch out for, proposed by Black Rock which can supercharge the start of the bull-run. In this piece, we shall see what will be the implications of the Ethereum’s ETF on the overall crypto market.

Speculations started dominating the cryptosphere that possibly the next in the line for ETFs would be Ethereum without a doubt; however, everything’s not well in the state of crypto because crypto exchanges which are vouching for an Ethereum ETF have found themselves in hot water ever since the SEC has taken matters into hand reconsidering that, unlike BTC, Ethereum is a PoS blockchain. However, the mixed stance of the SEC, in which they have not included ETH in the lawsuits filed against crypto exchanges somehow positively establishes the narrative that ETH could be inching closer to an ETF approval, nonetheless. However, the chances are just 50% at the time of writing. However, if the ETH ETF comes to fruition, it will have the following impact on the crypto market as a whole.

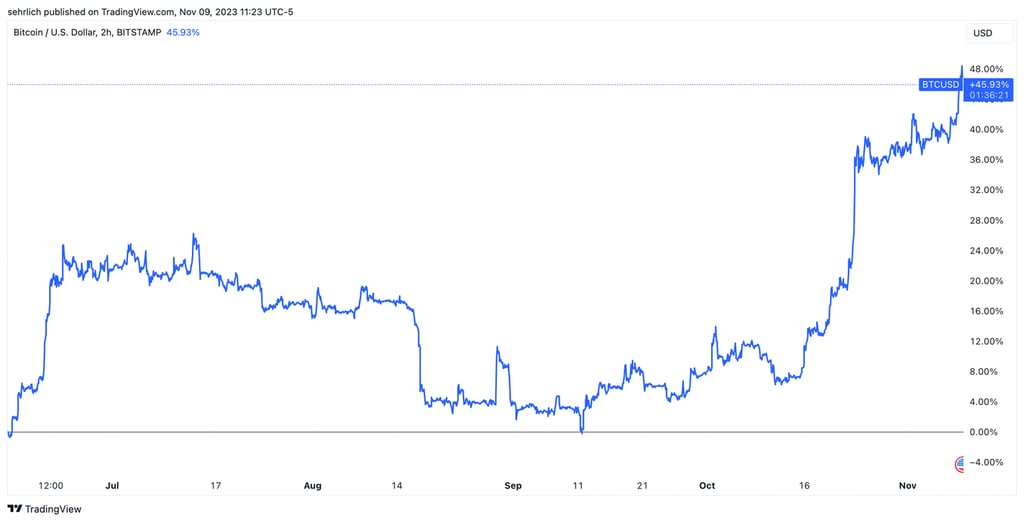

Post the BTC ETF approval speculations, the BTC market has been reverberating to the bullish sentiments. For example, ever since June 2023, BTC has appreciated way over by 45% because at that point of time, BTC was trading at somewhere around $27,763.20 as evident from the chart.

The same performance is expected for Ethereum and lately movements of Ethereum above the $2400 levels have been justifying that stance undoubtedly.

Right now, the positive narrative for the BTC ETF will be affecting the ETH’s lackadaisical movement in the last couple of months because like BTC has neutralized the volatility post the ETF roll-out, ETH could possibly have the same movements.

When you look at the above chart, ETH and BTC are mimicking the same movements in conjunction with the anticipation for ETFs. In addition to this, the Cancun upgrade would be another major event affecting the stabilization of ETH as a whole in a larger context. Why? Because, so far ETH has been present as not just a store of value due to its naturally turning deflationary laterly but also as a splendid ecosystem to build the next gen of DeFi, and RWAs. Hence, in all likelihood, it is highly expected that the ETF roll-out will positively impact ETH like BTC and we could most likely see major movements ahead.

Ether, is so far the most reliable crypto after Bitcoin and there are numerous crypto exchanges which have adhered to PORs to establish transparency. As a result, in the near future, if the ETH ETF is getting approved, we might see some major movements returning back to Ethereum like BTC. And a major trade-off is that on Grayscale Ethereum Trust, ETH is trading at an 18% discount from the Spot prices which might coerce more investors to look forward to ETH as a splendid asset class to take advantage of the arbitrage opportunity.

In this dynamic landscape, VE3 emerges as a valuable resource for investors seeking to navigate the crypto market with our robust blockchain capabilities. Through our comprehensive analysis and insights, we empower users to make informed decisions. By staying abreast of market trends and monitoring the evolving crypto landscape, we serve as a strategic partner for those looking to capitalize on the promising prospects of Ethereum as a compelling asset class. To know more, explore our innovative digital solutions or contact us directly.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.