Merchant survey 2025: Navigating the payment innovation divide

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

January 3 2025

by Payments Intelligence

What is this article about?

The FCA’s proposed safeguarding reforms for payments and e-money firms, aiming to enhance consumer protection and operational compliance.

Why is it important?

The reforms ensure robust safeguarding practices, bolster consumer trust, and address risks like fund shortfalls during insolvency.

What’s next?

Firms must invest in compliance, adapt workflows, and advocate for fair regulations.

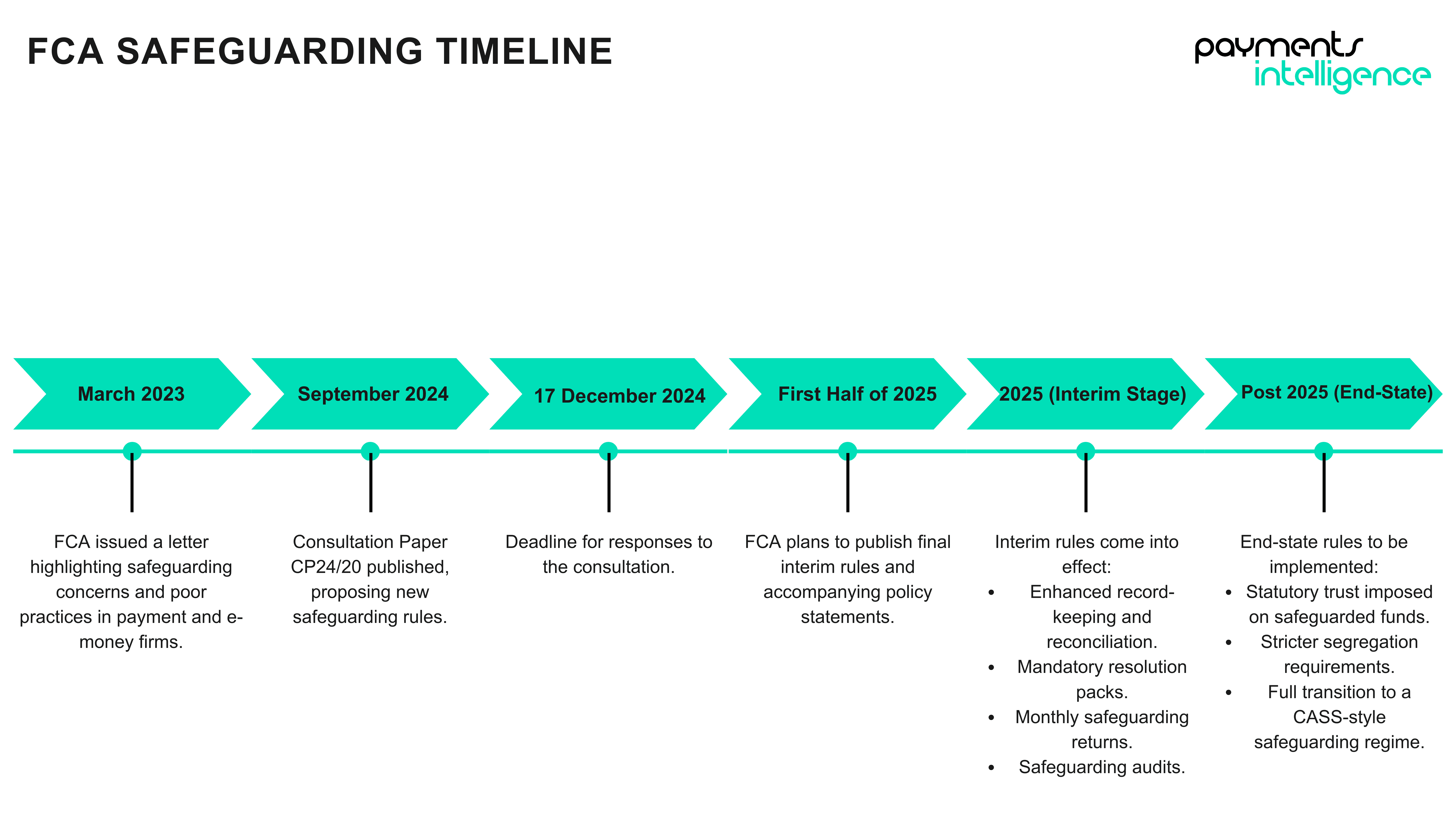

The Financial Conduct Authority (FCA) recently outlined significant changes to the safeguarding regime for payments and e-money firms in its consultation paper CP24/20. These reforms aim to enhance consumer protection, ensure the robustness of safeguarding practices, and align with evolving market conditions.

While the interim rules codify existing expectations with some enhancements, the proposed end-state rules introduce substantial shifts that could reshape the operational landscape for firms operating in this sector.

Central to these changes are new statutory trust requirements, more prescriptive record-keeping, reconciliation standards, and the mandate for external safeguarding audits. While these measures seek to address key risks, such as fund shortfalls during insolvency and delays in fund distributions, they also bring increased regulatory burdens and operational complexities. Industry stakeholders, including The Payments Association, have raised concerns about the proportionality, cost implications, and potential unintended consequences of these reforms.

The reforms are split into two phases: interim rules, which formalise and enhance existing safeguarding practices, and end-state rules, which introduce statutory trusts and stricter operational requirements.

1) Interim safeguarding rules:

2) End-state safeguarding rules:

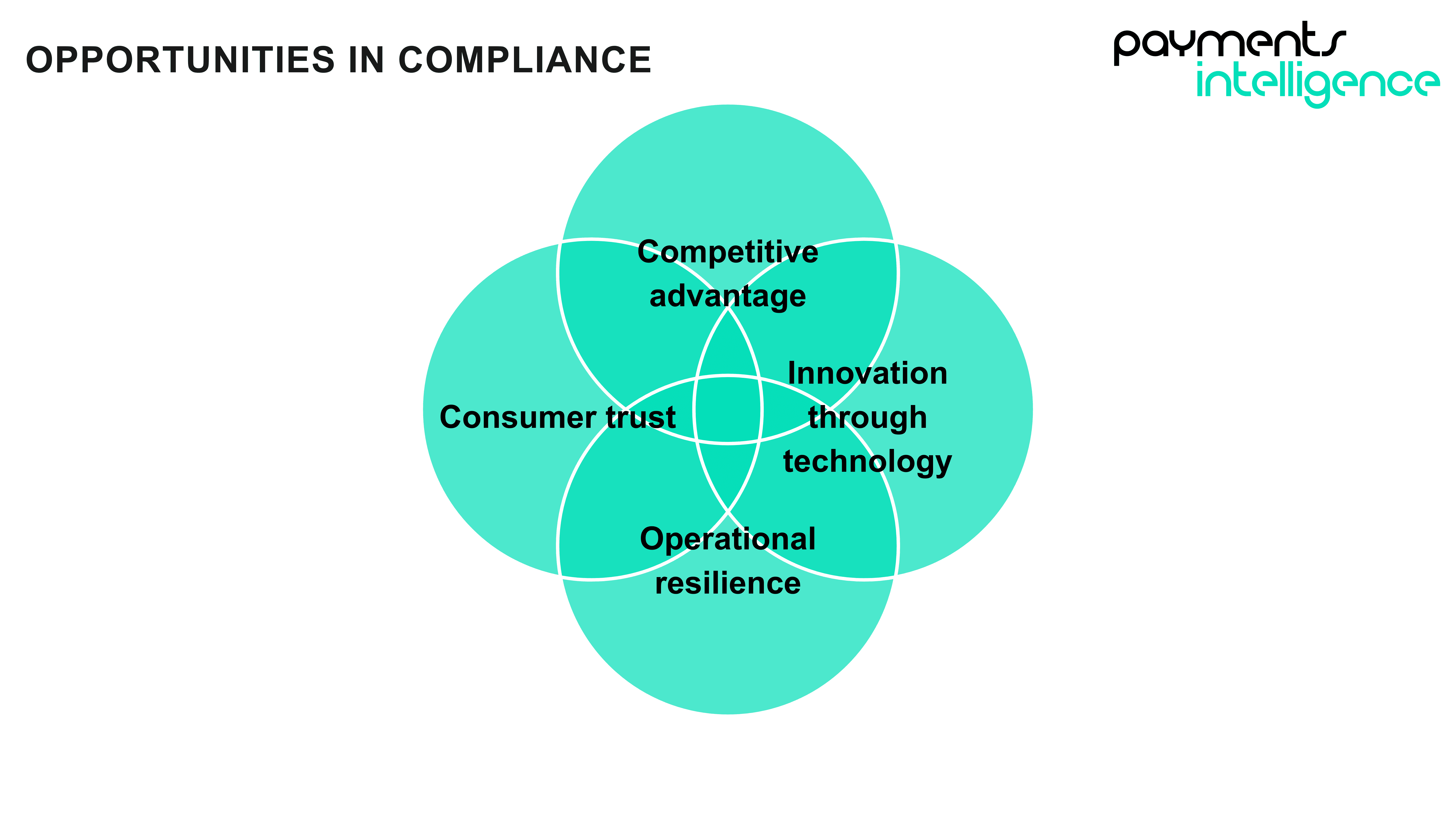

The proposed safeguarding reforms present both opportunities and challenges for payments and e-money firms. On the one hand, these changes aim to bolster consumer trust by ensuring funds are adequately protected and available in cases of insolvency. Enhanced transparency through detailed record-keeping and regular reporting, for example, can also improve market confidence and reduce regulatory interventions.

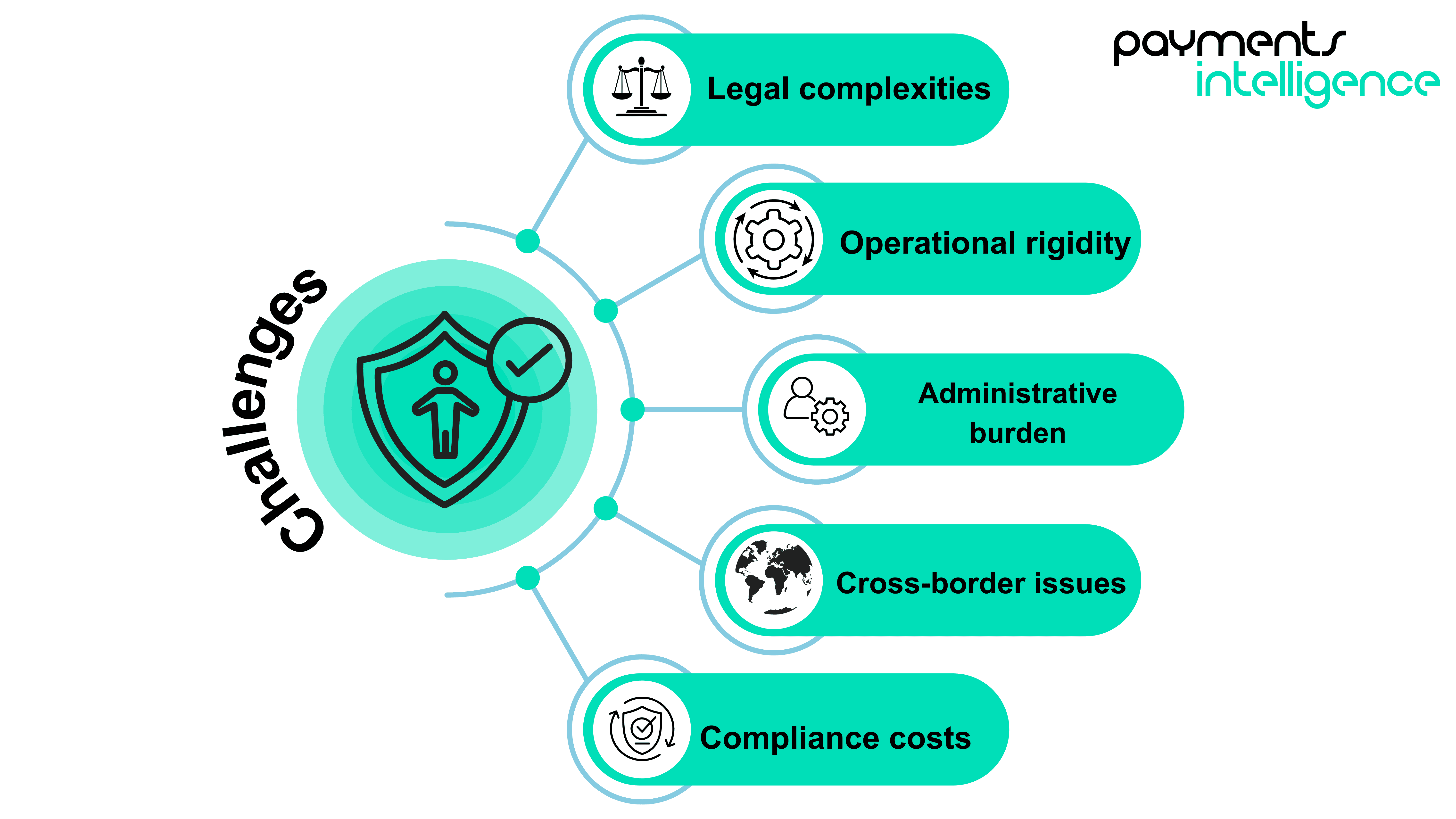

However, the reforms also impose significant operational and financial burdens. The immediate safeguarding of funds could strain liquidity for smaller firms, requiring adjustments to workflows and potentially increasing reliance on credit facilities. Statutory trusts, while beneficial for legal clarity, may prolong insolvency proceedings and introduce additional legal complexities, especially for cross-border operations. Stricter segregation requirements could limit operational flexibility, affecting firms offering diverse payment solutions, particularly those operating in international markets.

For firms to navigate these challenges effectively, strategic investments in technology, compliance expertise, and stakeholder engagement will be crucial. These measures will not only facilitate compliance but also position firms as leaders in safeguarding standards within the industry.

While the reforms offer a range of opportunities for firms, they also present a wide range of challenges, many of which stem from increased compliance costs, legal complexities, and operational constraints. Smaller firms, for example, are likely to bear the brunt of financial pressures introduced by the reforms with hiked compliance costs that come with implementation of new safeguarding workflows, engaging with auditors and fulfilling enhanced reporting requirements.

In addition to this, there could be issues around the legal uncertainties related to statuatory trust requirements, the ambiguities around how funds are treated across jurisdictions for example. Similarly, the the interaction of statutory trust rules with existing fiduciary duties, consumer protections, and insolvency laws could create conflicts, potentially delaying fund distributions and increasing legal costs.

In regards to operational flexibility, the reforms could pull up issues where the immediate safeguarding of funds comes into concern. These rigidities could significantly affect firms’ cash flow and liquidity management. Firms operating in multiple currencies or across differing time zones may face trouble in ensuring funds are instantly deposited into safeguarding accounts. This inflexibility could hinder their ability to offer competitive, innovative solutions, such as multi-currency wallets or cross-border payment services.

Firms with international clients face additional challenges in meeting safeguarding requirements. Jurisdictional differences in banking and regulatory practices can complicate compliance efforts, making reconciling safeguarding obligations across borders difficult. This complexity risks creating an uneven playing field, where UK firms are at a competitive disadvantage compared to their global counterparts operating under less restrictive regimes.

The requirement for monthly safeguarding returns and more frequent audits place an additional administrative load on firms. For many of the smaller entities, this could necessitate hiring additional compliance staff or investing in automated systems.

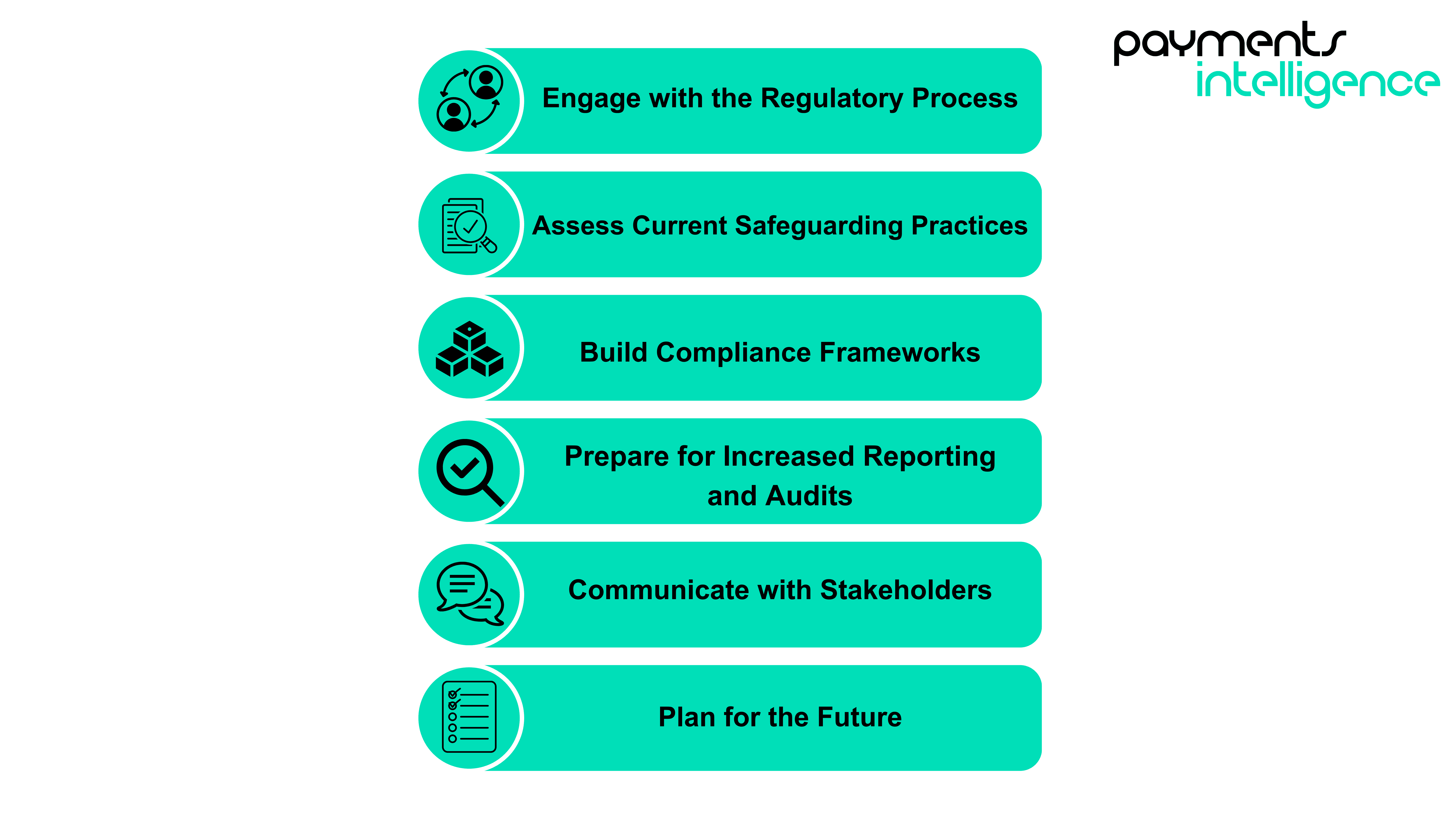

In order to navigate these challenges with the greatest efficiency, firms will need to follow a set of recommendations. The first being to engage with the regulatory process. Firms should actively participate in ongoing consultations and stay informed about developments related to the safeguarding reforms. Collaborating with industry groups like The Payments Association can also provide valuable insights and amplify the industry’s voice.

While this can be done in the background, another recommendation is to thoroughly review current safeguarding practises; conducting audits of existing measures will help to identify gaps relative to the new requirements. This will include evaluating record-keeping systems, reconciliation processes, and fund segregation practices. It is advised to ensure that the audit process aligns with both interim and end-state rules to minimise disruptions.

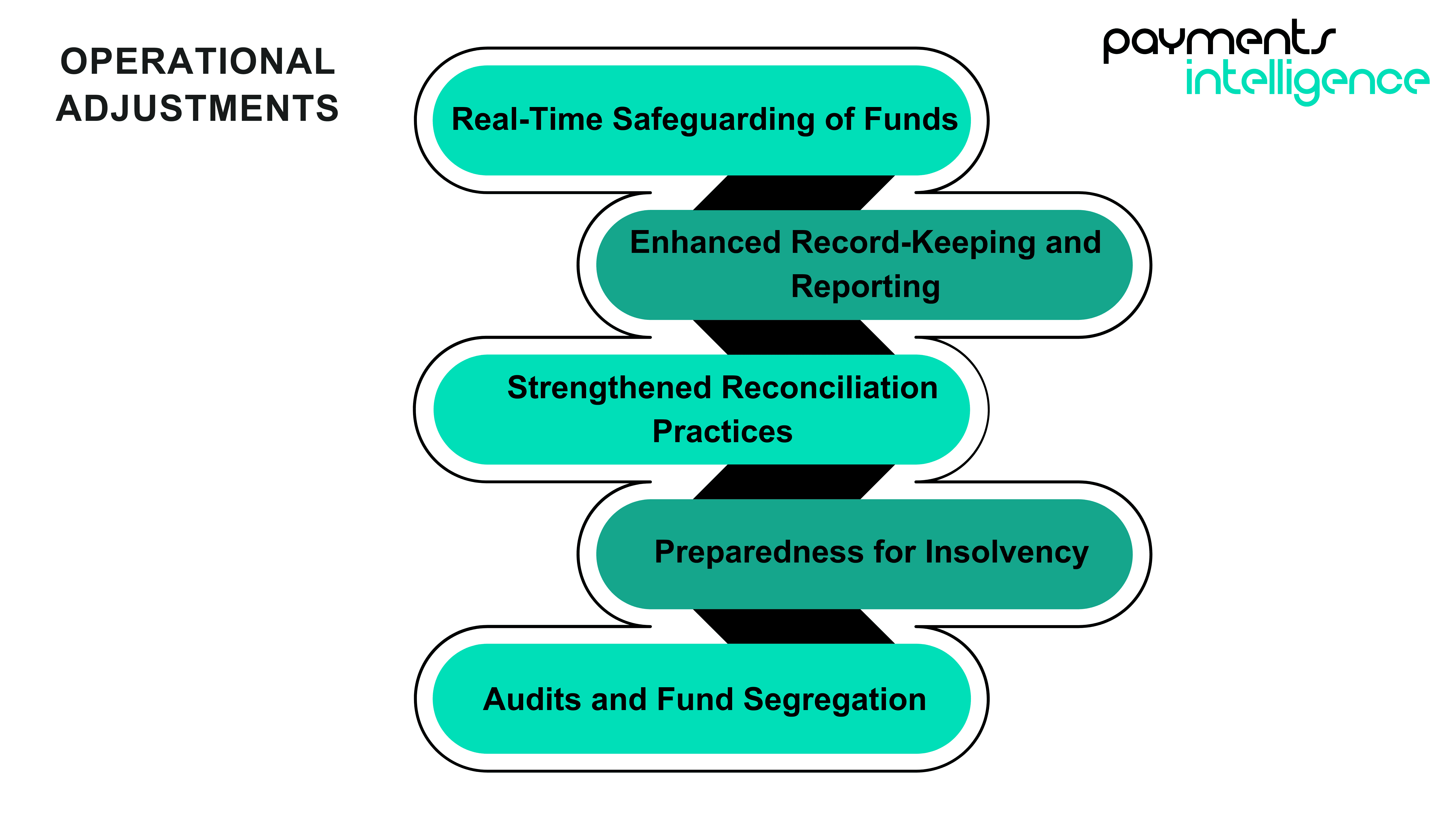

Able firms should consider investing in advanced technology and expertise to enhance compliance capabilities. Automation will help to streamline reporting and reconciliation tasks, reducing the risk of human error. In addition, preparing for operational adjustments to ensure immediate safeguarding of funds will play an important role. This may involve renegotiating terms with banking partners, adjusting fund management strategies, and securing additional credit lines if and where necessary.

Transparent communication with customers and partners about safeguarding practices can enhance trust and confidence. Demonstrating this level of proactive compliance efforts can serve as a competitive advantage. Meanwhile, preparing for potential insolvency scenarios by building robust resolution packs and ensuring readiness for statutory trust implementation. These measures will safeguard both customer funds and firms’ reputations.

The reforms, while challenging, also present significant opportunities for firms to strengthen their market position and customer trust. For example, implementing robust safeguarding measures will inspire consumer confidence, ensuring that funds are protected, even in worst-case insolvency scenarios, and will lead to stronger customer retention and acquisition, particularly in a competitive market where trust is paramount. Payment service providers (PSPs) and e-money firms that demonstrate proactive compliance and robust safeguarding protocols position themselves as reliable and stable partners.

The demand for streamlined compliance processes encourages investment in technological solutions; automated systems for reconciliation, record-keeping, and reporting reduce manual errors and free resources for innovation. These reforms encourage the adoption of transparent and structured operational practises, which in turn ensures compliance but also gives firms the ability to weather financial and operational risks, fostering sustainable growth.

To successfully navigate the FCA’s safeguarding reforms and ensure a balanced approach to compliance, firms must act collectively and strategically. Advocacy and alignment with broader regulatory frameworks will be critical.

These strategic actions will not only help firms adapt to the immediate challenges of compliance but also contribute to shaping a regulatory environment that balances robust consumer protection with sustainable industry growth.

A 2025 survey of UK retailers reveals how payment challenges and innovation priorities are shaping merchant strategies across the sector.

UK SME survey shows open banking intrigues merchants with faster, cheaper payments, but gaps in awareness and security fears slow adoption.

The Bank of England’s offline CBDC trials show it’s technically possible—but device limits, fraud risks, and policy gaps must still be solved.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.