Financial institutions are drowning in false positives, outdated compliance frameworks, and escalating operational costs. Fraud evolves daily, yet legacy systems take months to adapt—leaving businesses exposed. Complaer is changing that.

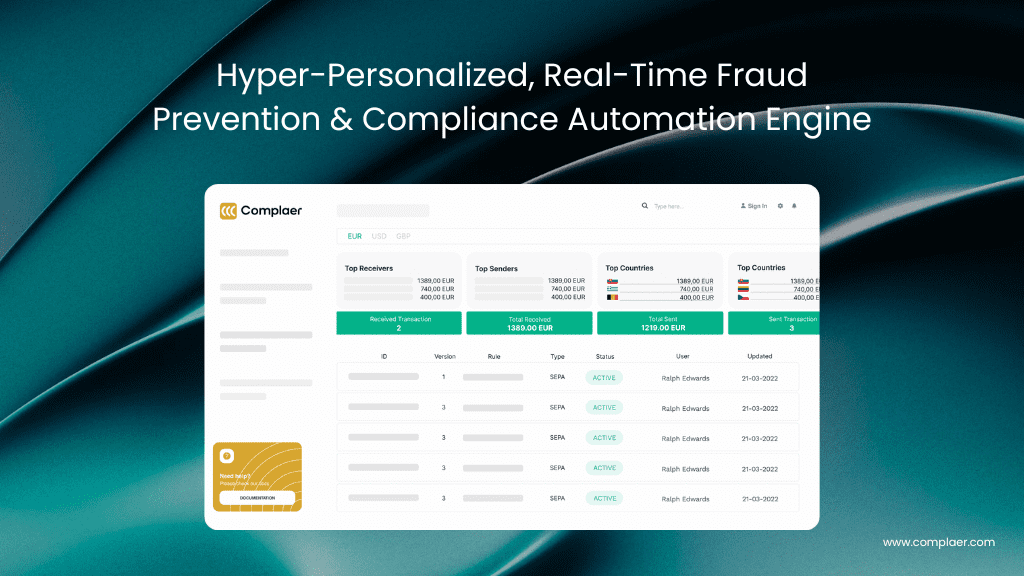

Complaer’s no-code fraud prevention engine puts compliance teams back in control, delivering real-time, hyper-personalised AML/CTF strategies without engineering support. Through automation, Complaer:

Reduces manual workflows by 60%+

Cuts false positives by 90%+

Detects threats in under 10 seconds

All while maintaining seamless compliance with MiCA, FATF, SEPA, and other evolving regulations.

Static fraud rules leave gaps: Fraud patterns shift daily. Legacy systems take weeks or even months to adapt.

Manual workflows are slow and costly: Compliance teams are overstretched and bogged down by repetitive investigations.

False positives overload teams: Over 90% of alerts are false—wasting time, money, and resources.

Regulatory complexity creates risk: Cross-border compliance is fragmented, raising exposure to fines.

The financial landscape is changing fast. Digital payments and crypto bring new risks that outdated tools can’t handle. Fraudsters are exploiting AI, automation, and regulatory gaps faster than ever—making real-time fraud prevention non-negotiable.

Real-time fraud detection: Automated precision identifies threats in under 10 seconds

No-code, dynamic rule engine Deploy, test, and modify rules instantly—no engineers required.

Seamless fiat, card, and crypto compliance: One API covers AML/CTF across all transaction types.

90%+ false positive reduction: Focus on real threats, not noise.

60%+ compliance workflow automation: Slash operational costs and free teams to focus on high-value tasks.

Cross-border compliance adaptability: Stay aligned with shifting regulations in real-time.

Unlike rigid, slow legacy systems, Complaer offers a flexible, pay-as-you-grow model that scales with your business—whether you’re a lean fintech or a global bank. Compliance teams gain the power to act instantly, automate with ease, and cut costs without adding headcount.

Regulatory pressure is increasing. Institutions that can’t keep up face fines, reputational fallout, and bloated operations. Traditional systems demand heavy engineering input to change fraud rules—making fast response impossible.

Complaer removes this bottleneck. Its No-Code Rule Engine empowers compliance teams to build and deploy detection rules instantly—no IT dependency required.

One API for total compliance: SEPA, SWIFT, crypto, cards—unified AML/CTF across the board.

Intelligent fraud prevention: Automatically flags high-risk activity in real-time.

Regulatory resilience: Instant adaptation to new compliance frameworks and legislative shifts.

Resource optimisation: Do more with less by automating manual, repetitive processes.

“The financial industry can’t afford slow compliance anymore. Fraudsters move fast—your compliance engine should move faster. With Complaer, financial institutions finally get real-time, adaptable fraud prevention that doesn’t break their budget or require engineering bottlenecks.”—Tom Saltanov, CEO & co-founder, Complaer

Compliance should scale like tech—not like legacy finance. Complaer’s architecture means even small teams can access enterprise-grade tools with pricing that grows with your business.

As the sector shifts toward real-time, hyper-personalised compliance, Complaer is leading the way—blending automation, adaptability, and ease of use in one platform.

Outdated systems can’t keep up with modern threats or regulatory expectations. With Complaer, financial institutions gain a future-ready platform that:

Adapts instantly to fraud patterns

Scales without adding headcount

Ensures full, cross-jurisdictional compliance

Find out how Complaer can transform your compliance strategy today.

Contact Us: [email protected] | complaer.com

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.