What is this article about?

The emergence of UNITE Global, a new entry in the cross-border payments industry, and its potential impact on this sector. It focuses on UNITE Hub, a platform offering real-time cross-border payment solutions with improved efficiency and reduced costs.

Why is this important?

Highlights a significant innovation in the financial industry which addresses long-standing issues in cross-border payments and proposes a new infrastructure that could enhance operational efficiency, reduce costs, and improve liquidity management.

What’s next?

Central banks and industry to collaborate to assess the feasibility and benefits of integrating with platforms like UNITE Hub.

2024 will herald much innovation in the payments world, with digital currencies and digital wallets firmly entering the mainstream and grabbing the lion’s share of headlines. However, UNITE Global — a new entrant currently flying somewhat under the radar — could enjoy one of the most impactful debuts for many years to shape the future of a critical payments marketplace.

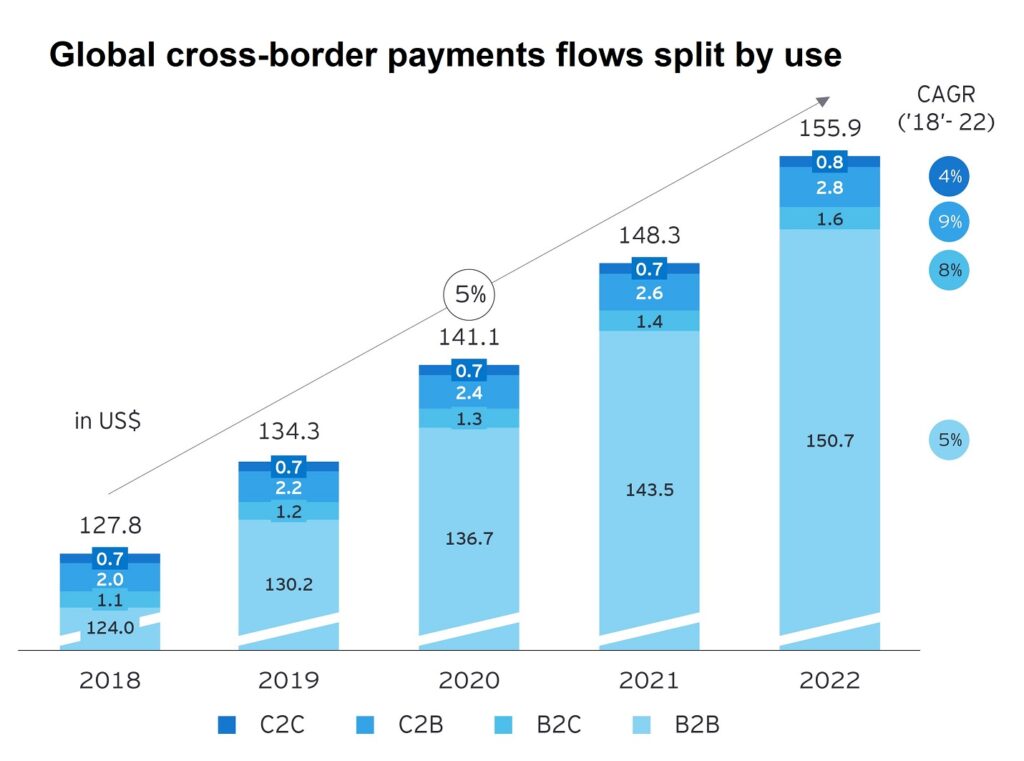

Cross-border payments, with flows just shy of US$160 trillion (£125 trillion) in 2022 and expected to grow to $290 trillion by 2030 (FXC Intelligence), remain the lifeblood of global trade and are critical for the near-$700 billion of global remittances to low and middle-income countries (World Bank) worldwide.

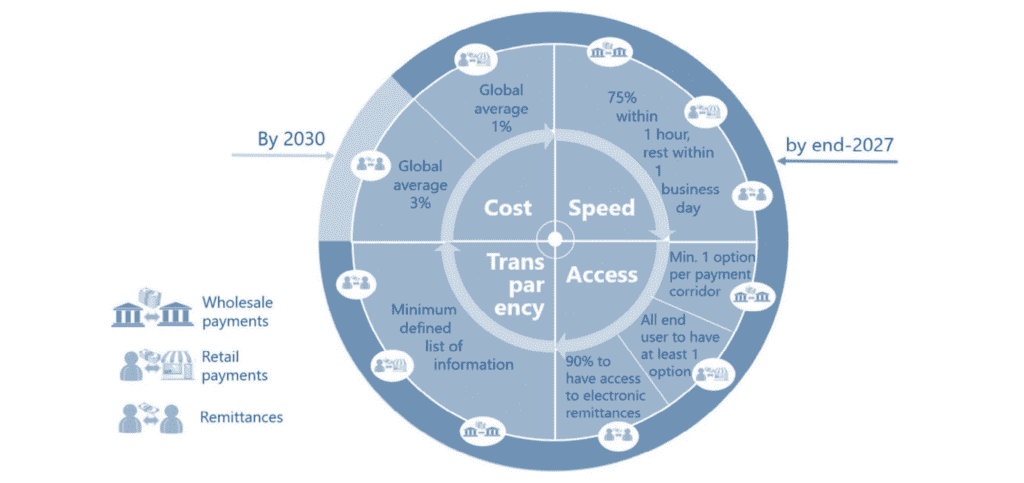

Reducing cost per transaction and dramatically improving transmission speeds in this business are two key G20 goals for the payments industry. However, the 2027 deadline looks set to prove too high a hurdle.

In its October 2023 progress report on the ‘Roadmap for Enhancing Cross-border Payments’, the G20 noted that, while some headway had been made, there was still “a considerable distance to go and more needs to be done across all of the key areas for action”.

In 2024, UNITE Hub, a new payments market infrastructure — effectively a centralised-processing common cross-currency platform for direct bank-to-bank real-time cross-border transfers — is set to come online.

UNITE’s chief technology officer, Tord Coucheron, describes the Norway-based payments business as a “correspondent hub for banks” – a turn-key solution to meeting G20’s targets for enhancing cross-border payments.

UNITE is a next-gen, future-proof cross-border payments alternative to the historic Swift-based correspondent banking model. “It levels the playing field for smaller and medium banks to engage in international trade payments on fair terms regardless of their size (of balance sheet) and payment volumes,” says Coucheron.

Not to be confused with money transfer payment fintechs, UNITE is designed to be a new payments infrastructure — a common ledger cross-border banking with super centralised liquidity in central bank money.

Within this, UNITE Hub is a cloud-native messaging-, networking-, FX-, and cash management platform for banks that will enable real-time cross-border payments clearing and instant settlement utilising immediately available liquidity.

Cross-currency transfers and access to liquidity are two elements of cross-border payments that can add complexity and cost with delays and a lack of transparency.

Indeed, with interest rates at multi-year highs, the cost of many hundreds of billions of dollars of clients’ cash trapped in the cross-border payments nexus globally is a very real and growing problem for the industry.

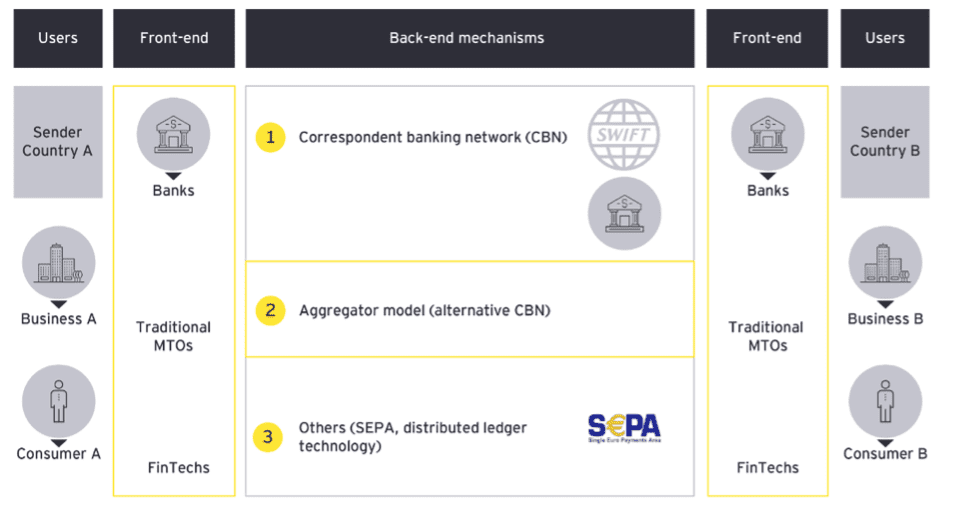

As discussed in The Payments Association’s November 2023 white paper, ‘King for a Day: Chartering the Future of Cross Border Payments’, technology can, and needs to, reposition and redefine the role of correspondent banking after a 33–50% drop in the number of active correspondent banks across Africa, Central and South America and Europe in the past decade.

Coucheron’s view on where UNITE will hold the edge over existing systems and practises centres around speed and its use of central banks, “UNITE Hub transfers value and payment at the same time and settles at the same time in a secure medium — central bank money. Currently, payment fintech players that offer money transfers in multiple currencies are corridor-based solutions, moving value using the existing (historic) banking rails to settle the payments in commercial bank money, with liquidity held across multiple accounts at partner banks in different jurisdictions.”

Availability of liquidity is a critical piece of the puzzle. Liquidity optimisation tools and technological improvements are set to be a major focus and competitive advantage for winning business and lowering costs across the payments industry in 2024 and beyond.

Technology has enabled vastly increased client visibility into liquidity positions. Higher interest rates have increased scrutiny of this multi-trillion dollar ‘float’ of cash held across the pipelines of global payments networks.

McKinsey’s ‘2023 Global Payments Report’ estimates that liquidity revenues in 2022 totalled $750 billion globally; too high for regulators to ignore, with Asia at about 60% of the total and the majority of this coming from the commercial side.

Settlement is about liquidity, and real-time settlement is about having liquidity available concurrently as the payment clears. Centralised liquidity is when a bank has all its [domestic currency] liquidity in the same place while accessing other foreign currencies using its nostro accounts held with foreign banks (i.e. the incumbent correspondent banking method). Super-centralised liquidity (SCL) is when a bank holds all of its liquidity (domestic and foreign currencies) in the same place; in this case, UNITE Hub, where it is accessible in real-time.

UNITE Hub can thus ensure liquidity in each foreign currency for all participating banks is kept safe, round the clock, in central bank money, in the respective currency’s jurisdiction. SCL means a shortfall in one currency can easily be funded in real-time with another currency residing within the same central platform.

A cross-currency common platform such as UNITE Hub could perhaps facilitate some disintermediation of the US dollar by offering user banks a single access to all currencies supported on the platform.

Thus, trade payments between user banks could be settled in real-time in the respective currency pair for each trade, with the UNITE system auto-updating the ledger entries for both banks. This would imply there is no need to convert to US dollars or, indeed, any other intermediary currency, thereby materially improving speed and cost efficiency.

But how realistic is this in the actual world? Coucheron is realistically circumspect on this point, noting that “using dollars or euros, for that matter, is a practical matter, but the world is changing. The fact is that the majority of imports have no connection with the US or Europe beyond the currency on the invoice. For instance, a supplier in Malaysia selling to an importer in UAE has no real need for US dollars other than to convert it into Malaysian ringgit to pay local salaries, taxes, etc., or to pay its suppliers in other markets.”

“The dynamics affecting the US dollar’s role as a reserve currency is far more complex than some headline news suggest, and any material de-dollarisation and decline of the US dollar’s role in global finance is likely to take much longer than some currently anticipate.”

To date, there isn’t a single truly global cross-border payments system, and, realistically speaking, given the complexity (geopolitics, culture, economics, national interests) and fragmentation of financial markets, it is unlikely that there will ever be a single global system. Coucheron’s view is that it is more likely that one more dominant system (UNITE) will emerge, co-existing with a few other systems. Will UNITE take that trophy?

There are two predictions we are comfortable making about the hugely important cross-border payments space. Firstly, national interests will ensure that progress will be slow, hampered by scepticism and self-interest. Secondly, where central banks and industry can collaborate and cooperate – and it looks like UNITE has made a good start here – what can be achieved regarding cost and speed efficiency will begin to emerge. And that can only be a good thing.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.