The evolving digital economy brings powerful advantages for online payments businesses – and new opportunities for fraudsters.

There’s a clear need for robust security. Veriff’s US Fraud Industry Pulse Survey 2024 found that almost 87% of payment industry leaders had seen an increase in online fraud from April 2024.

And it’s hitting them financially. Almost 90% had suffered a financial hit of between 1% and 9%, which could represent millions of dollars of lost revenue depending on company size.

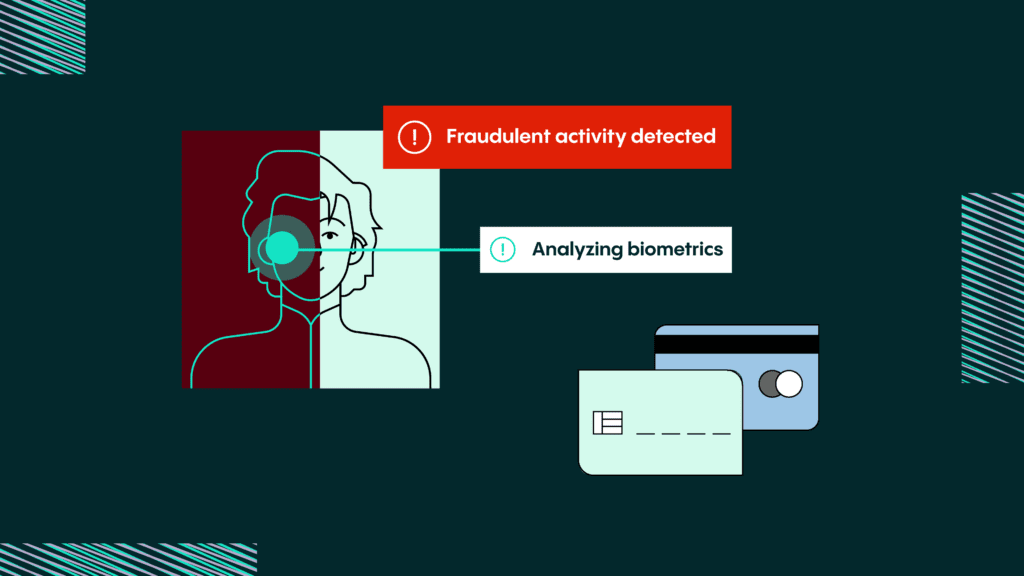

It’s little wonder, then, that they’re looking to bolster their defences. The vast majority (nearly 98%) are using Identity Verification and/or biometrics in fraud prevention already, with a similar proportion planning to go further in the next year.

Biometrics-based authentication tools are based on a person’s physical characteristics, which are unique to the individual involved. That means they are ideal for stopping the account takeover-type fraud that is so common in the payment space.

There are many types of biometrics analysis, including analysing a person’s fingerprint, gait, or eyeball, but facial biometrics are most useful to payments providers.

Facial biometrics can be captured by taking a selfie on the user’s camera, laptop, tablet or computer – there is no need for specialist equipment like fingerprint scanners. The user takes a selfie, and the biometric analysis compares it to a stored biometric template or government ID to confirm that the user is who they say they are.

Facial biometrics as an authentication method are far more secure than passwords, for example, because they are much more difficult to steal. They are more secure than device-based tokens, which assume that a genuine person has their device with them, or one-time passcodes, which assume that the passcode has reached the intended recipient without being intercepted or diverted.

Facial biometrics are also more accurate than other identification methods because they are more able to confirm the human presence in the session and that the human is the right person in their selfie—something that is not possible when only requiring users to type in a password or shared code.

They also boost the user experience because customers don’t need to remember cumbersome passwords or other login details to access an account.

And for the payments platform, they can also save organizations time and money – customers never need to remember their login information, so there’s no need to waste resources on resetting passwords on accounts or assisting customers through account verification or re-verification.

We know that payments organisations must securely authenticate users without disrupting the user experience. This matters across the entire customer journey, particularly at critical steps such as account access, undertaking a high-risk activity, or recovering an account.

With facial biometrics, you can offer secure authentication combined with user-centred authentication and a streamlined experience. You can access seamless identity assurance and enjoy the benefits of adaptive technology and explainable decision-making that is customisable and scalable for your needs.

For payment companies facing a growing threat of increasingly sophisticated online fraud, verifying users instantly, conveniently, and securely while beating the fraudsters is a win-win for platforms and users alike.

For more information on what biometrics are and how they can help your business, download this Ultimate guide to biometrics

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.