What is the article about?

The evolution of financial crime in 2023, highlighting challenges like AI fraud and social media exploitation, using data from Cifas’s 2024 assessment.

Why is this important?

It provides insights to help payment firms develop strategies to protect their operations and consumer trust against rising threats.

What’s next?

Refining fraud prevention strategies to tackle evolving challenges, leveraging technological advancements and law enforcement collaboration.

As financial crimes grow in complexity and sophistication, payment firms find themselves at the forefront of the battle to safeguard their operations and consumer trust. The industry is now confronting emergent threats driven by advancements in technology, such as AI-generated fraud and social media exploitation, amidst challenging economic conditions. These complex threats necessitate a strategic, informed approach to fraud prevention.

Key to navigating these challenges is the deployment of updated and comprehensive assessments. Cifas’s Strategic Intelligence Assessment 2024, leveraging data from its National Fraud Database (NFD) and Internal Threat Database (ITD), provides essential insights. These resources, made available to The Payments Association’s Payments Intelligence, draw from a broad network of fraud prevention partners and law enforcement, offering a detailed view of the evolving landscape of financial crime. This intelligence is crucial for payment firms aiming to develop proactive strategies to stay ahead in this dynamic and demanding environment.

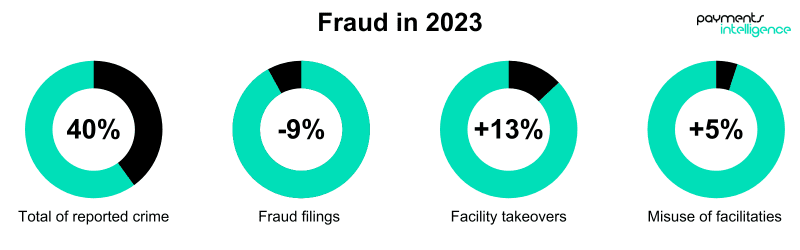

According to the Strategic Intelligence Assessment 2024, the fraud landscape in 2023 is defined by contrasting developments: a 9% reduction in overall fraud filings from the high levels of the previous year, contrasted with the sobering reality that fraud still constitutes 40% of all reported crimes to the police.

Despite progress in some areas, the emergence of sophisticated forms of fraud, such as facility takeovers, which have jumped by 13%, represents an ongoing challenge. Against this backdrop, Sally Felton, director of fraud risk management at BDO, emphasises the need for payment firms to quickly adapt to new fraud typologies using “a combination of technology and human interaction.” She explains to Payments Intelligence the importance of guarding against “less sophisticated frauds as well as the slick, digitally focused crimes.” Felton insists, “Fraudsters will always exploit poor controls and gaps in processes, so it is vital for payments firms to regularly assess their operations broadly and end-to-end to highlight any weaknesses.”

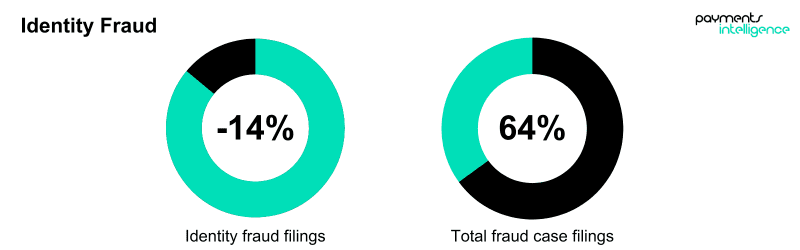

Identity fraud filings have fallen by 14%, but they still account for a significant 64% of all reported financial crime cases. The sector most impacted is payments, particularly personal current accounts, which have seen a rise of 12% in such fraud. On the other hand, fraud involving plastic cards has seen an 8% reduction.

Data insights from Cifas:

Technological advancements have presented fraudsters with new opportunities to exploit digital banking platforms. Social media is becoming a significant vector for fraud, especially for recruiting unwitting participants into schemes. The slight uptick in online fraud occurrence to 89% is also an interesting change.

While the data reveals that impersonation fraud has declined by 11%, it continues to be a prevalent issue, primarily affecting the plastic card sector. Conversely, there is a significant 49% decrease in telecom fraud.

“The escalation of identity fraud poses serious threats, as seen in the surge of sophisticated methods like deepfake technology, which cost a multinational company $25.6 million in Hong Kong,” says Andrew Novoselsky, chief product officer, SumSub, emphasising the dangerous sophistication of recent frauds. He further advises, “Companies must adopt a blended approach to security, implementing multi-layered protection at various stages of the user journey to effectively mitigate these evolving risks.”

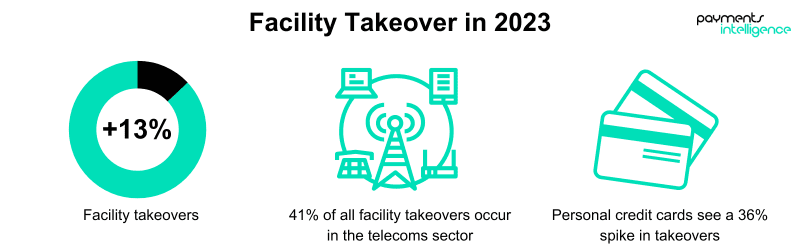

Facility takeovers rose 13% in 2023. The telecommunications sector is particularly hard hit, with Cifas data showing a 59% increase in reported incidents.

Data Insights from Cifas:

The allure of fraudsters in the telecommunications sector is primarily driven by the lucrative opportunities presented by mobile phone products. Fraudsters commonly impersonate mobile network operators and retailers to deceive customers into revealing sensitive information or to directly acquire new products or services illegitimately.

Despite online retail facing the largest reduction in cases, it remains the second most impacted, accounting for 27% of the total facility takeover filings.

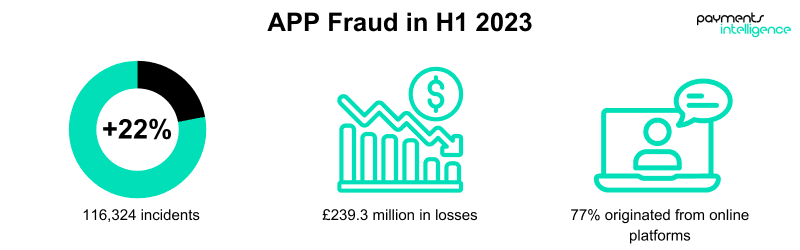

Authorised Push Payment (APP) fraud continues to be a prevalent challenge, with fraudsters exploiting online platforms and telecommunications to deceive victims into authorising payments to accounts they control. Despite a slight decrease in total losses, the volume of cases has risen significantly, according to UK Finance’s 2023 Half Year Fraud Update report.

Data insights from UK Finance:

According to the report from UK Finance, the increasing use of digital platforms for transactions has made them prime targets for APP fraud, with criminals employing sophisticated scams like fake investment opportunities and romance scams. Additionally, it found that fraudsters increasingly use scam phone calls and texts, which, while fewer in overall cases, lead to higher individual losses.

In October 2023, the Payments Systems Regulator (PSR) released an Authorised Push Payment (APP) fraud performance report on APP fraud by 14 PSP groups. According to Jane Jee, the lead for the Financial Crime Working Group at The Payments Association, the PSR is set to publish the next cycle of APP scam data in July 2024, after collecting this data in February 2024. She also noted that before the new rules take effect in October 2024, Pay.UK is required to submit its compliance monitoring proposals to the PSR by 5 April 2024, with the final version of the reimbursement rules and the approved compliance monitoring regime to be published by 7 June 2024.

According to Sally Felton, while the industry is waiting to see the impact of the new PSR regulations on APP fraud, “criminals won’t stop scamming people simply because new rules are coming in.” Education remains an important tool in a firm’s defence, she explains, yet it can be costly to produce quality messaging for customers and there are various views on how important and impactful it can be, with some key consumer groups questioning its effect.

Jee emphasised to Payments Intelligence the importance of proactive measures in fraud prevention, stating, “While it is good news that the PSR is ensuring that most consumers are to be reimbursed, the primary goal should be to detect and prevent APP scams before they occur.” She highlighted that 2024 would see the establishment of standards and frameworks enabling institutions to share data on customers to better understand and combat financial crime trends. “Fraudsters share data freely,” she said, “and we must ensure that institutions can do so if we are to prevent fraud, which can have such devastating and often life-changing consequences for victims.”

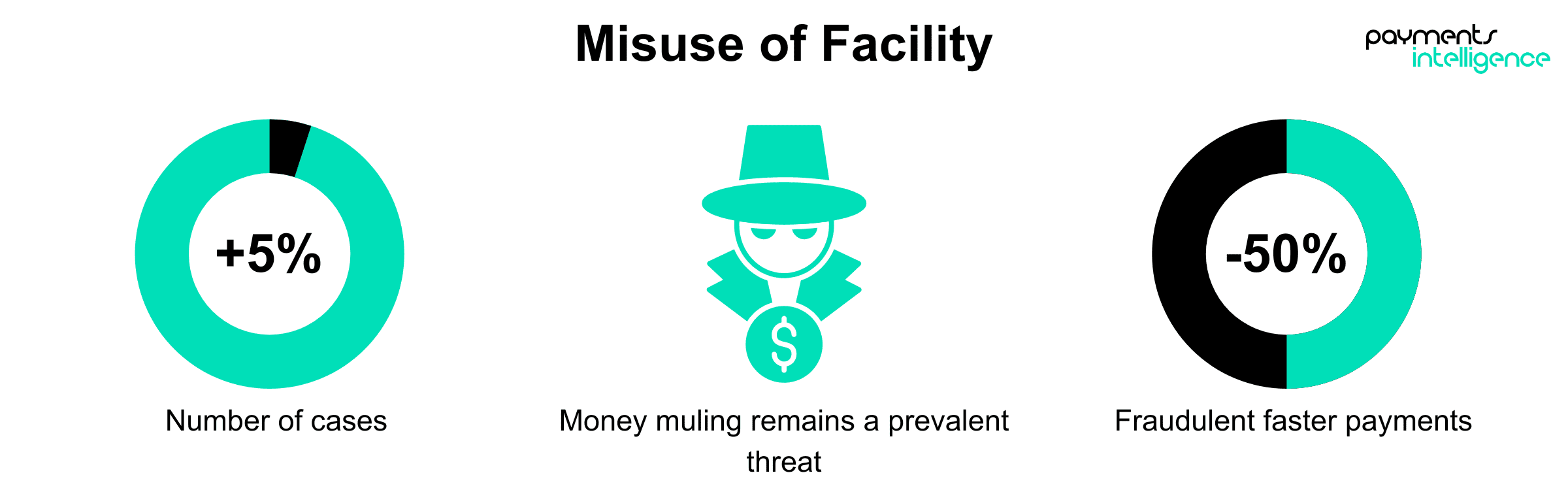

The misuse of facility has seen a 5% uptick in cases, according to Cifas, now accounting for 21% of all fraud filings. The increase is particularly noticeable in loan products, which have experienced an 82% surge, pointing to the potential effects of the cost-of-living crisis as individuals may seek to evade payments or illicitly acquire assets.

Money muling remains a pressing concern, and social media is a critical tool for recruitment. The 21-25 age group is especially targeted. Although there’s been a 6% reduction in cases showing behaviour indicative of money muling, the fact that it still represents a major portion of bank account misuse filings suggests a persistent challenge.

The banking sector has also noted an uptick in cases where the origin of funds cannot be explained, reflecting a 3% increase. This indicates a deeper issue within the financial system, where unexplained wealth is a growing anomaly.

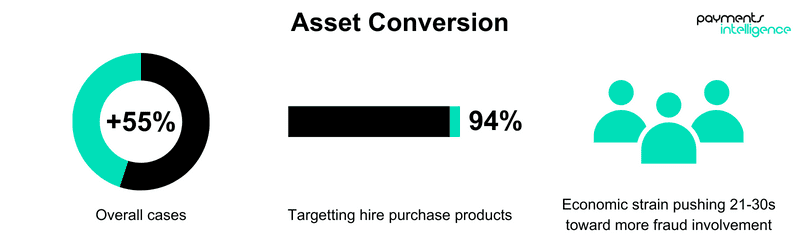

Asset conversion marked a significant 55% increase in cases in 2023. This trend signals a concerning shift in fraud dynamics, propelled by economic pressures and the cost-of-living crisis, highlighting the urgent need for stringent asset management and verification processes within the financial sector.

The trend points towards a shift in fraud dynamics, with financial pressures acting as a catalyst, leading to more individuals, particularly within the 21-30 age bracket, resorting to fraudulent methods for financial relief. This demographic change indicates a significant expansion in the range of individuals implicated in such fraudulent activities.

Given the rapid increase in cases and the economic factors at play, the financial sector’s challenge is to tighten controls around high-value asset transactions. This will involve not only stricter verification protocols but also greater awareness and monitoring of the patterns that may indicate fraudulent intentions.

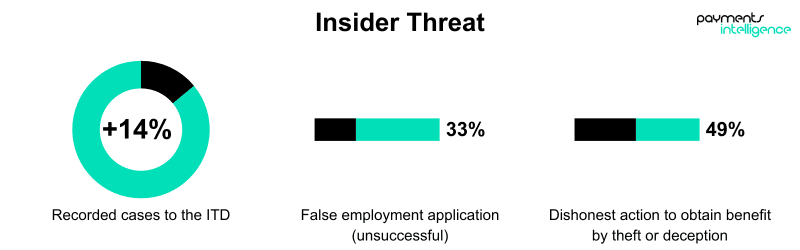

The financial sector is increasingly grappling with insider threats, evidenced by a 14% rise in filings to the Insider Threat Database (ITD) in 2023, finds Cifas, summing up to 325 recorded individuals. This escalation is reflective of not just the prevailing economic uncertainties but the intricate challenges posed by evolving work models, such as hybrid environments. It underscores the imperative for bolstered internal safeguards and more rigorous employee monitoring mechanisms.

Data insights from Cifas:

This comprehensive investigation of the evolution of financial crime in 2023, as detailed in Cifas’s 2024 Strategic Intelligence Assessment, underscores the pivotal challenges and opportunities leaders in the payments sector face in combating fraud. Key findings reveal both progress in specific areas and persistent vulnerabilities that require strategic attention. Notably, facility takeovers and identity fraud continue to be significant threats, fuelled by the adoption of advanced technologies and tactics by fraudsters, such as deepfake technology and the exploitation of social media platforms.

As part of this ongoing series examining critical fraud data, this report serves as an essential resource for payment firms seeking to enhance their fraud prevention frameworks. It highlights the necessity for an integrated approach that combines technological innovation with robust collaboration with law enforcement to adapt to and mitigate these evolving threats effectively.

Looking forward, refining fraud prevention strategies remains a top priority. This involves not only leveraging the latest technological advancements but also enhancing data-sharing protocols among financial institutions to foster a more proactive stance against fraud. Indeed, as Sally Felton says, the view of many fraud professionals both within banks, payments services firms and professional services is that future focus and fraud prevention/detection initiatives need to include provision for better data sharing, across multiple industries and platforms. “Data privacy and sharing rules designed to protect the individual can often be seen as restrictive in crime prevention, and moving forward into the future, many feel this needs to change.”

The insights provided here are instrumental for payment leaders striving to protect their operations and, crucially, maintain consumer trust in an increasingly digital and economically strained landscape. As we continue this series, each report will build on the last, providing leaders with the intelligence needed to stay ahead of the curve in a dynamic financial environment.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

Development note: Shows when the article IS from Payments Intelligence, AND when a reader is NOT a member of TPA

Development note: Shows when the article IS from Payments Intelligence, AND when a reader is NOT a member of TPA

Development note: Shows when we know someone IS logged-out, IS a subscriber and IS a member (i.e. Cookie “role” is NOT set to “guest, customer, non-member” and “is_subscriber” is “true”)

Join The Payments Association and unlock a world of benefits:

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.