Unveiled: Key Financial Crime 360 findings

A deep dive into the Financial Crime 360 survey, highlighting key challenges, prevalent fraud types, and strategic responses across various financial sectors

What is this article about?

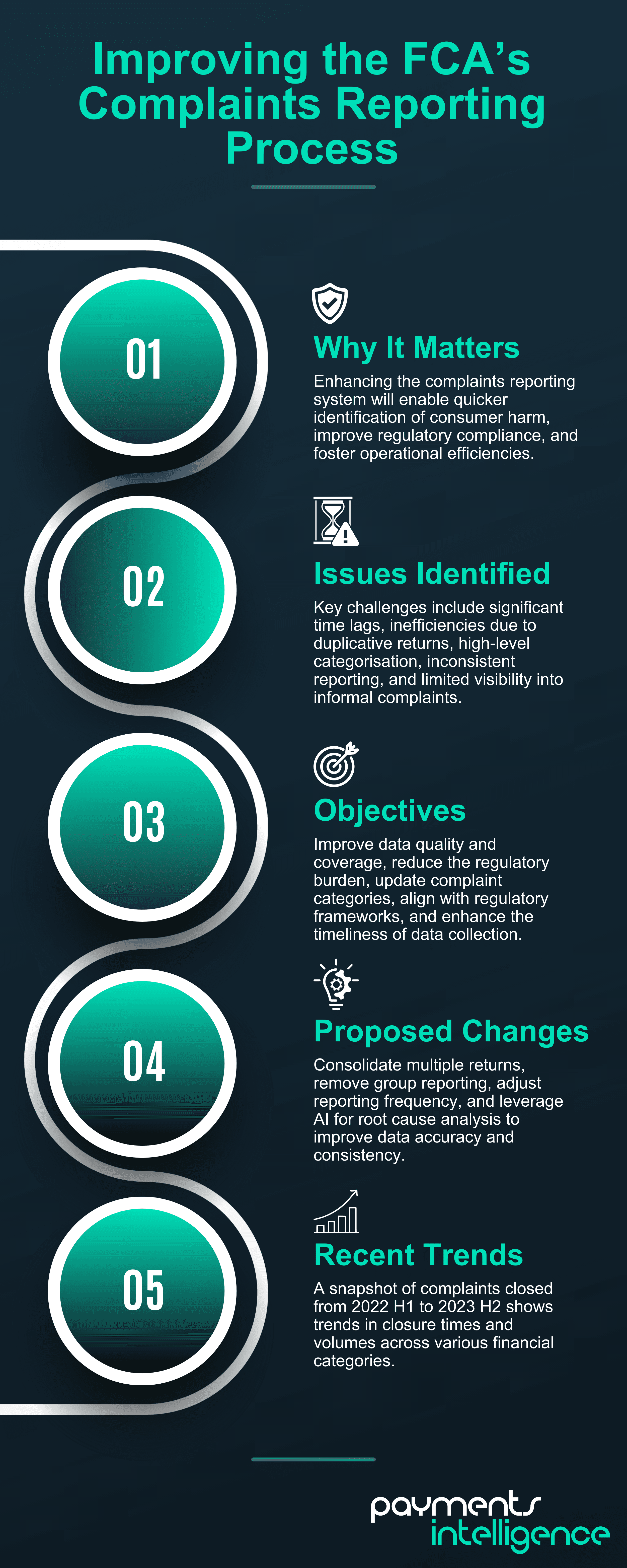

The Financial Conduct Authority’s (FCA) initiative to improve the complaints reporting process for financial firms.

Why is it important?

Enhancing the complaints reporting system will enable quicker identification of consumer harm, improve regulatory compliance, and foster operational efficiencies.

What’s next?

Engaging with industry stakeholders, testing proposed changes, and potentially implementing more frequent and granular reporting to better identify and address issues promptly.

The Financial Conduct Authority’s (FCA’s) complaints reporting review is a comprehensive initiative aimed at modernising and enhancing the current process for financial firms. Its key objectives include improving data coverage and quality to identify potential consumer harm better, reducing time lags in data collection to enable swifter regulatory action, and streamlining the reporting process to minimise unnecessary duplication and regulatory burden.

The review also seeks to update complaint categories to reflect current industry issues such as fraud better, explore ways to adjust reporting frequency based on firm size and complaint volume and improve the overall usability and accessibility of the reporting system.

Central to this effort is the FCA’s commitment to engaging with industry stakeholders, gathering feedback, and testing proposed changes before implementation, ensuring that the revised process meets both regulatory needs and industry practicalities.

FCA Senior Manager, Consumer and Retail Policy, Jonathan Pearson, tells Payments Intelligence: “The FCA welcome the opportunity to speak to the industry, and their valuable insight will help us carry out our review of complaints reporting requirements.

“We want to work with firms to improve the quality of complaints data we receive as well as complaints returns and guidance while ensuring that any changes we make are proportionate.”

Effective complaints reporting in the financial sector is crucial for maintaining the integrity and stability of the industry. It serves as a vital tool for consumer protection by enabling regulators to identify and address issues promptly, while also providing firms with valuable insights to improve their products and services.

Proper complaints handling and reporting help maintain trust in financial institutions, ensure regulatory compliance, and offer a window into emerging market trends and consumer expectations.

Moreover, it acts as an early warning system for potential widespread issues, allows for performance measurement and industry benchmarking, and can drive operational efficiencies. Ultimately, a robust complaints reporting system contributes to a healthier, more responsive financial sector that better serves its customers and maintains public confidence.

Category | Investments | Insurance & Pure Protection | Home finance | Decumulation & pensions | Banking and credit cards |

|---|---|---|---|---|---|

2023 H2 | 61,512 | 753,859 | 94,844 | 86,885 | 874,573 |

Source: Financial Conduct Authority

Attendees of a recent consultation session between The Payments Association and the FCA identified several issues with the current complaints reporting process. Key challenges include significant time lags in data collection, which hinders quick identification and resolution of issues, and inefficiencies due to multiple, often duplicative returns.

High-level categorisation fails to provide deep insights into root causes, making it difficult to spot specific issues or emerging trends. Meanwhile, inconsistent reporting across firms is complicating industry-wide comparisons, while limited visibility into informal complaints further compounds the issue.

Additionally, aligning complaints data with newer regulatory frameworks, such as consumer duty, and discrepancies between FCA reporting categories and firms’ internal taxonomies create mapping difficulties, leading to a troublesome lack of traceability in complaints data across different regulatory bodies. The current system struggles to link complaints data directly to actual customer harm, and the volume of data makes quick pattern identification challenging.

Pozitive Payments uses complaints data to map against Consumer Duty outcomes, believing it useful in identifying gaps in complaints reporting. Janet Johnston, the company’s chief risk and compliance officer, says: “If for example, a communication sent to customers raised a number of complaints or enquiries then we would investigate how we could have been clearer in our communication to ensure that the ‘Customer Understanding’ outcome was met. Likewise, an upward trend in the number of complaints regarding product usage would prompt us to review the product offering and modify if required.”

All complaints | All complaints | All complaints | All complaints | |

|---|---|---|---|---|

Period | 2022 H1 | 2022 H2 | 2023 H1 | 2023 H2 |

Grand Total | 1,912,296 | 1,762,998 | 1,898,858 | 1,840,026 |

Complaints closed within 3 days | 51.05% | 46.46% | 45.51% | 44.85% |

Complaints closed > 3 days but within 8 weeks | 43.69% | 47.67% | 46.85% | 49.05% |

Complaints closed > 8 weeks | 5.25% | 5.87% | 7.63% | 6.11% |

The FCA is conducting a thorough review of complaints reported by regulated firms. The focus is on the complaints themselves, not the firms reporting them.

The key objectives include enhancing data quality and coverage to identify potential consumer harm better, reducing the regulatory burden on firms by eliminating unnecessary duplication, and improving the timeliness of data collection to enable quicker regulatory action.

The review also seeks to update complaint categories to reflect current industry issues, explore ways to adjust reporting frequency based on firm size and complaint volume and improve the overall usability of the reporting system.

Additionally, the FCA aims to align complaints reporting with other regulatory frameworks and enhance its ability to spot trends and address emerging issues promptly.

Ultimately, the review seeks to create a more efficient, effective, and responsive complaint-reporting system that benefits both regulators and financial firms.

There are a number of changes which could be implemented towards reporting structure to address current inefficiencies, while also improving data quality. One of the key focuses of the FCA is the consolidation of multiple returns based on firm permissions. The regulator is hoping this will reduce duplication and streamline the reporting process.

Alongside the consolidation of returns, the FCA is considering removing group reporting to simplify requirements further and adjusting reporting frequency with the possibility of moving towards quarterly reporting for larger firms while tailoring requirements based on firm size and complaint volume.

Santander UK Head of Complaints Strategy & Insight, Brodie Sinclair, explains that while the FCA uses high-level categories, banks like Santander have hundreds of lower-level categorisations that roll up into these broader groups.

“This granularity allows banks to quickly identify root causes of issues and understand specific drivers of complaints,” he says. For example, where the FCA might have a general category like “Disputes over sums/charges”, a bank’s internal system would break this down into more specific issues such as whether the complaint relates to interest, charges or fees, and then if driver is due to these having been applied incorrectly, not refunded, or at the wrong rate, for example.

This level of detail enables banks to route complaints to the right teams, capture nuanced data about new products or services, and gain a much deeper understanding of customer issues than the FCA’s broad categories allow.

He suggests that the regulator could improve its process by working with firms to understand their existing categorisation systems and create common, more detailed categories that firms could easily align with. He argues that better categorisation would lead to more meaningful data and insights, benefiting both the regulator and the firms.

According to Sinclair, artificial intelligence (AI) could potentially benefit root cause analysis of complaints in several ways. It could automate some of the manual analyses currently performed by people, allowing for faster and more complete processing of a larger volume of complaints. “You could then have the AI indicating what the complaint is about and rely on AI to categorise the complaints, rather than a human, which might mean you’ve got more consistent and accurate data,” he tells Payments Intelligence.

AI could also support existing staff, freeing them up to focus on deeper, more detailed analysis. It could also package up many of the manual tasks in the complaint process, allowing human staff to focus more on service quality, empathy and restoring the relationship.

Sinclair emphasised that the key is to have AI support human activity and do a better job overall rather than entirely replacing human analysts or complaint handlers.

The Financial Conduct Authority’s (FCA) initiative to enhance the complaints reporting process represents a significant step towards modernising regulatory oversight in the financial sector.

To effectively address key challenges such as data coverage, timeliness, and usability, it is important to streamline reporting requirements and enhance the quality and granularity of complaints data. These improvements are crucial for promptly identifying consumer harm, ensuring regulatory compliance, and fostering operational efficiencies within financial firms.

For smaller firms, it is easier to tailor complaints reporting to meet the FCA’s specific requirements, Johnston admitted. She says: “The current reporting system does not provide the FCA with complaints data across the customer journey and against Consumer Duty outcomes which would be beneficial.”

A deep dive into the Financial Crime 360 survey, highlighting key challenges, prevalent fraud types, and strategic responses across various financial sectors

CEOs discuss top challenges and priorities in a Payments Lab roundtable, focusing on technology, fraud prevention, and regulatory compliance.

The financial struggles of UK adults highlight the vital role and challenges of community finance institutions in promoting financial inclusion.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.