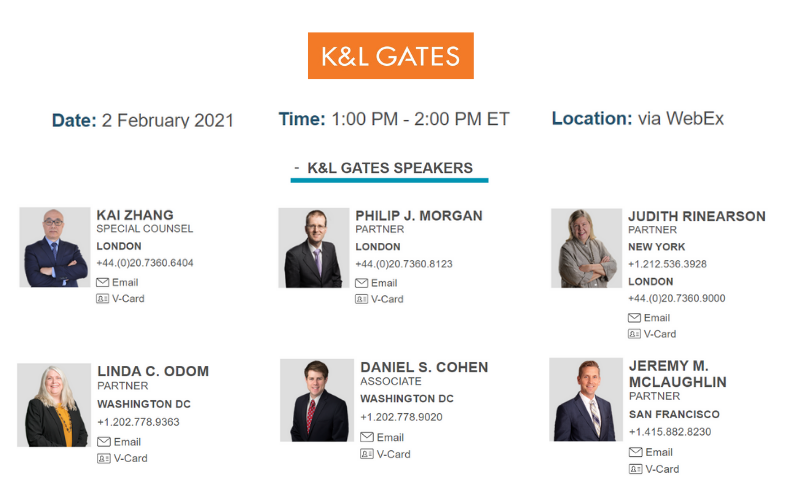

Join us for a cross pond webinar focusing on the enormous changes that are expected to impact payments in the US and UK featuring:

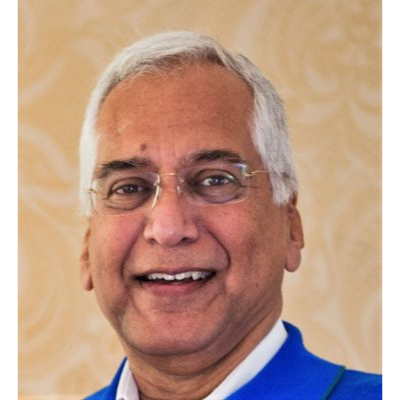

•In London, new K&L Gates Special Payments Counsel, Kai Zhang, and Partner, Philip Morgan.

•In New York, Partner and Global Fintech Co-Chair, Judie Rinearson.

•In Washington DC, Partner and Technology Law Specialist, Linda Odom, and Associate, Daniel Cohen.

•In San Francisco, Partner, Cryptocurrency and Fintech Lawyer, Jeremy McLaughlin.

Topics to be covered include:

•Expected changes to be implemented by the new US Democratic administration

•New leadership in the CFPB, SEC, OCC, and CFTC and what it means for banks and Fintechs

•UK and the implementation of Brexit with respect to payments and banking

•Anticipated changes in providing payment services to the UK and Europe

•The outlook for Fintech investment, Mergers and Acquisitions in the next 12 months on both sides of the pond

•What products and services are the winners and losers from these sweeping changes? Mobile apps? Traditional banking? Digital assets, stable coins and cryptocurrencies?