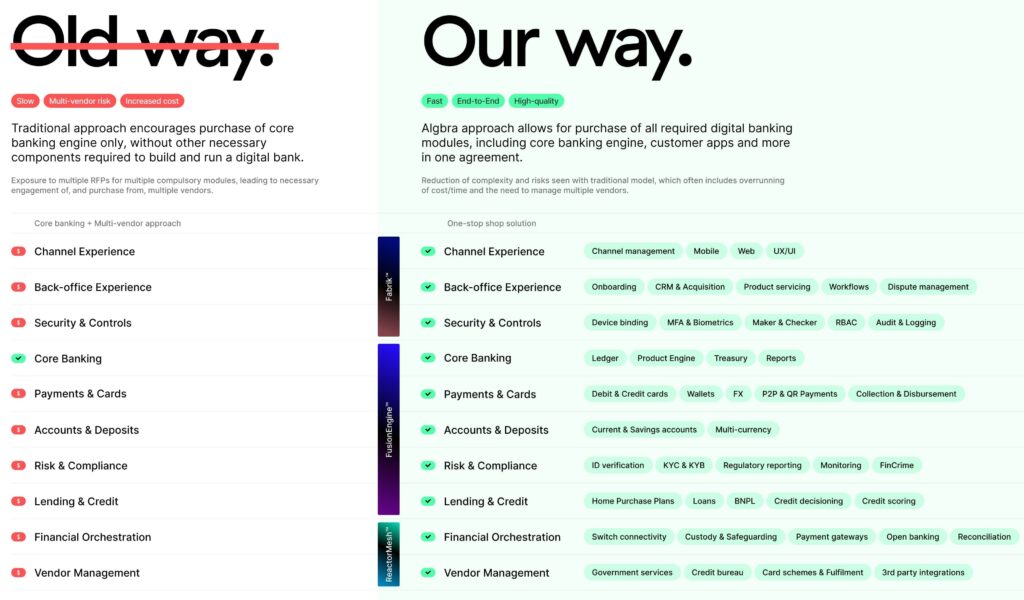

Building digital financial platforms has typically required outsourcing extensive products and services—from the core banking engine to app design to back-office tooling, often requiring engagement with multiple vendors. This has forced the end client to run multiple RFPs and mix and match the successful bidders, making the process of building digital financial platforms time-consuming and costly and, in far too many cases, resulting in sub-par quality.

In response to these pain points, Algbra Labs has innovated through its fintech-as-a-service (FaaS) approach, a one-stop shop for building, launching, and even running digital financial platforms and products.

Impressed by Algbra Labs’ FaaS model and technical capabilities, SC Ventures, the innovation arm of Standard Chartered Bank, recently enlisted the Algbra team to build, launch and run its sustainable savings platform Shoal with the goal of delivering the next generation of sustainable savings. Reflecting on the partnership, Tom Mason, co-founder of Shoal and former group chief of staff at Standard Chartered, commented: “By moving from the traditional BaaS model to working with Algbra Labs’ FaaS offering, we’ve probably gone further and faster in the last four months than we did in the previous two years”.

So, what is FaaS? And how can it change the way banks and companies build, launch and run digital financial services?

“Traditionally, core banking solutions include ledger, product, and treasury management with reporting capabilities. However, these features alone are insufficient to launch a new digital banking proposition. A comprehensive proposition requires many additional components such as payments, cards, vendor management, accounts, deposits, and a robust back-office experience,” says Anton Laurens, lead full stack engineer at Algbra Labs.

Algbra Labs’ FaaS solution can be grouped into three main components:

By incorporating these comprehensive features, Algbra Labs’ FaaS solution ensures that all necessary components are in place for launching a fully functional digital banking proposition. This makes it an unparalleled platform in the fintech industry, capable of addressing the diverse needs of modern banking propositions with unprecedented flexibility. Crucially, you can choose as much or as little as you need, making it a solution for any type of need and type of organisation.

Mason adds that “under the FaaS model, clients are provided with as much or as little as they need to launch and scale. There is no bundling and no unnecessary cost—as founders of Shoal, we have been able to pick from a menu of services across technology, product development, customer acquisition and support, ongoing monitoring and AML right through to marketing and data analytics. This enabled us to design a package that does exactly what we need with no wasted effort or cost.”

Within just four months of starting the partnership with Algbra Labs, Shoal was built and ready to go live.

Find out more about and get in contact with Algbra Labs here.

Read more about Shoal here.

The Payments Association

St Clement’s House

27 Clements Lane

London EC4N 7AE

© Copyright 2024 The Payments Association. All Rights Reserved. The Payments Association is the trading name of Emerging Payments Ventures Limited.

Emerging Ventures Limited t/a The Payments Association; Registered in England and Wales, Company Number 06672728; VAT no. 938829859; Registered office address St. Clement’s House, 27 Clements Lane, London, England, EC4N 7AE.

Log in to access complimentary passes or discounts and access exclusive content as part of your membership. An auto-login link will be sent directly to your email.

We use an auto-login link to ensure optimum security for your members hub. Simply enter your professional work e-mail address into the input area and you’ll receive a link to directly access your account.

Instead of using passwords, we e-mail you a link to log in to the site. This allows us to automatically verify you and apply member benefits based on your e-mail domain name.

Please click the button below which relates to the issue you’re having.

Sometimes our e-mails end up in spam. Make sure to check your spam folder for e-mails from The Payments Association

Most modern e-mail clients now separate e-mails into different tabs. For example, Outlook has an “Other” tab, and Gmail has tabs for different types of e-mails, such as promotional.

For security reasons the link will expire after 60 minutes. Try submitting the login form again and wait a few seconds for the e-mail to arrive.

The link will only work one time – once it’s been clicked, the link won’t log you in again. Instead, you’ll need to go back to the login screen and generate a new link.

Make sure you’re clicking the link on the most recent e-mail that’s been sent to you. We recommend deleting the e-mail once you’ve clicked the link.

Some security systems will automatically click on links in e-mails to check for phishing, malware, viruses and other malicious threats. If these have been clicked, it won’t work when you try to click on the link.

For security reasons, e-mail address changes can only be complete by your Member Engagement Manager. Please contact the team directly for further help.